Get started with Connect Invest

If you’ve ever looked at the stock market and thought, “I just want something more predictable,” you’re not alone.

The constant ups and downs can be exhausting, especially if you prefer consistency over excitement.

That’s one of the reasons I decided to take a closer look. Connect Invest. And the more I dug into how it works, the more I realized that it ticks a lot of important boxes for a certain type of investor.

Now, let me be clear from above. This is not a recommendation and is not financial advice. I’m not telling you where to put your money.

what i am What we’re doing is showing you how Connect Invest works, who it’s designed for, who it’s probably NOT for, and what you should realistically expect if you decide to try it.

To put some interest into the game, I invested $1,000 of my own money into Connect Invest so I can walk you through the process firsthand and show you what it really looks like from the inside out.

Connect investment rating

Summary

Connect Invest offers predictable returns backed by real estate with monthly interest payments and a low minimum investment of $500. The fixed-term structure takes the guesswork out of investing, and its track record of never missing a payment to investors since 2010 is reassuring. Best of all, you don’t have to be an accredited investor to participate.

As you explore alternatives to stock market volatility, Connect Invest is a strong contender for stable, hands-off income.

Get started with Connect Invest

Advantages

- Monthly interest payments

- Low minimum investment ($500)

- Open to non-accredited investors

- Real estate secured with first lien position

- Fixed and predictable returns (7.5% to 9% APY)

- No investor payments have been lost since 2010

- Short term options available (6 months)

- Mobile app for easy tracking

Cons

- Lack of Liquidity (the money is blocked for the term you choose)

- Not FDIC Insured

- Website needs a redesign and update

What is Connect Invest?

![]() Connect Invest is a real estate backed company loan platform. That’s an important distinction.

Connect Invest is a real estate backed company loan platform. That’s an important distinction.

- You are not buying properties.

- You are not managing tenants.

- You are not choosing individual offers to invest in.

- You do not own any of the properties you have invested in.

Instead, your money is pooled and lent for a host of real estate projects, including land development, residential projects, and other real estate-backed loans. The key idea here is that you participate in the loans, not the ownership.

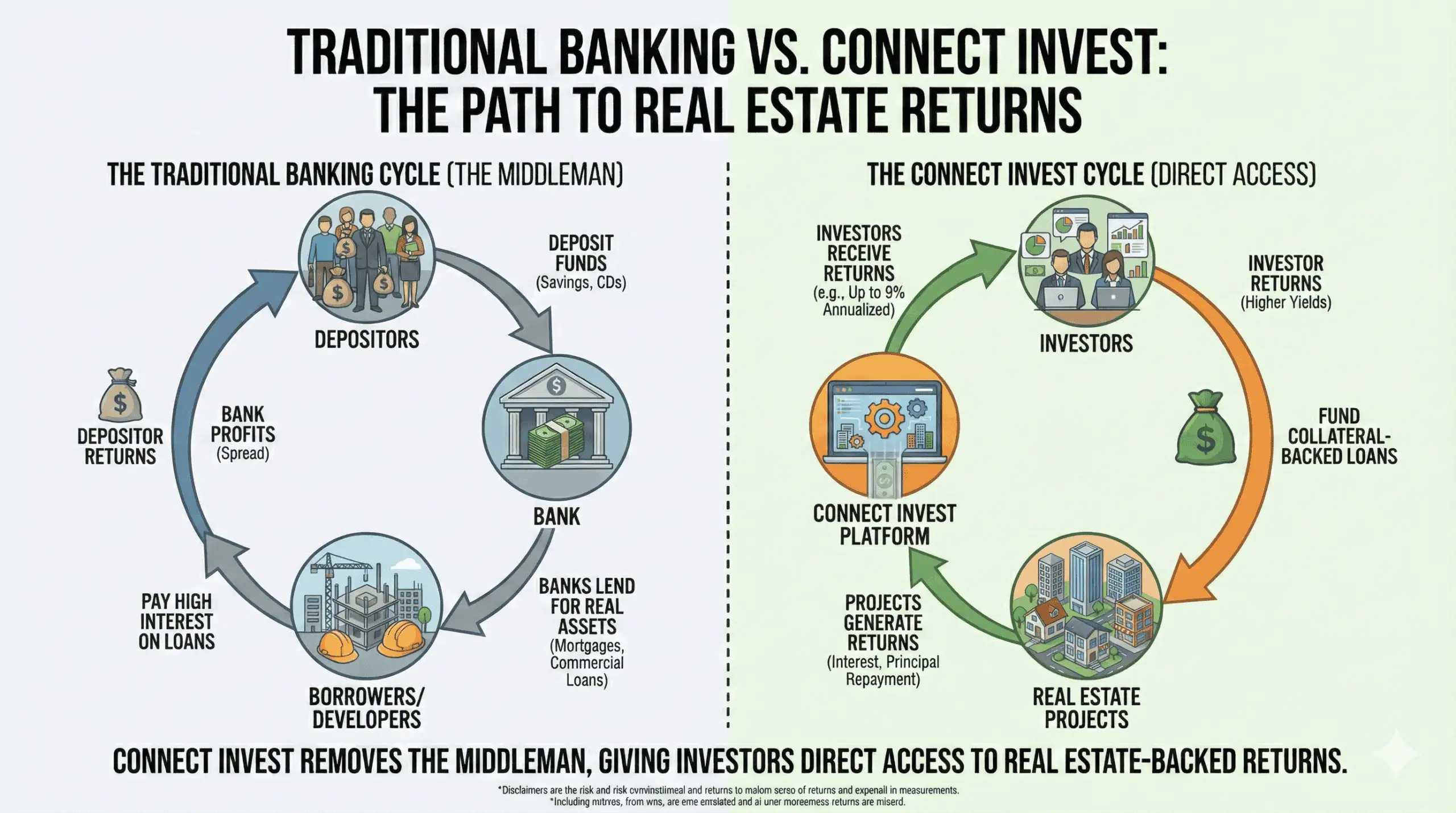

If you are familiar with how banks work, the concept is quite similar. Banks lend money backed by real assets, earn interest on those loans, and then pay depositors a small portion of that return. Platforms like Connect Invest essentially remove the bank from the middle and give investors more direct access to those returns.

How does Connect Invest work?

When you invest, you can choose a fixed term for which your money will remain. At the time of writing, the options look like this:

- 6 months around 7.5% APY (or 7.75% if you opt for automatic transfer)

- 12 months about 8% APY

- 24 months about 9% APY

The basic idea is simple: For every six months you’re willing to tie up your money, you’ll get about half a percent more in return. These are not guaranteed returns, but are the expectations Connect Invest sets from the beginning.

Behind the scenes, Connect Invest takes your money and lends it to developers working on various real estate projects. Those developers pay a slightly higher interest rate than you receive, creating a margin that allows Connect Invest to make money while paying you the APY they promised.

One of the biggest advantages here (and something that really caught my attention) is that your interest is credited to your account. monthly. If you know anything about how some of the other investment platforms in this space work, it’s a big deal. You don’t have to invest your money and then wait years before you get a single dollar back. You will see returns in your account within the first month or two.

To put it in context, with my $1,000 investment at 7.75% APY on the six-month rollover note, I can expect to earn approximately $6.46 per month. Obviously, that’s not going to change anyone’s life, but it illustrates how math works. And if you invested substantially more, those monthly payments would increase accordingly.

Why would anyone invest in Connect Invest?

Beyond the monthly payments, there are other important advantages worth mentioning.

The minimum investment is only $500. Not $100,000, not $50,000, not even $10,000. Five hundred dollars. That’s a small enough amount for any serious investor to scrape together if they really want to give it a try. Compare that to buying your own property, where you could need tens of thousands (or hundreds of thousands) just for a down payment, and $500 starts to look pretty affordable.

You do not need to be an accredited investor. In other words, you don’t have to be rich to be able to invest. Many of these investment platforms won’t even take your money if you can’t check the accredited investor box, and that’s a hard box for a lot of people to check. With Connect Invest, as long as you can raise $500, are a US citizen, and are at least 18 years old, you’re good to go.

Your investment has guarantees behind it. The money you invest through Connect Invest is lent to real estate projects, where Connect Invest has a first lien position on those loans. So if things ever go wrong, your money has a guarantee to back it up. That’s something the stock market simply can’t offer you.

The type of person who gravitates toward Connect Invest is usually looking for something more predictable, something that generates monthly income, and something that is actually backed by a tangible asset. They’re not trying to hit home runs. They want constant, boring but predictable returns. And honestly, when I look at all my investments, the boring ones are my favorites.

What is the registration process like?

The registration process is quite simple and took me less than 10 minutes to complete. Here’s the quick summary:

- Go to the Connect Invest website and click “Start Investing.”

- Fill out your basic information, create a password, and verify your email.

- Choose how you want to invest (cash or IRA).

- Confirm your identity by providing your name, address, Social Security number, and date of birth. Since they require an SSN, you will need to be a US citizen or legal permanent resident.

- Connect your bank account through Plaid (a fairly standard and familiar process if you’ve ever linked a bank account to any online platform).

- Choose your investment term, fund your account, review the agreement and sign.

After completing this process on Friday, my money appeared on the board the following Thursday. From there, I could see my investment, maturity date, and all relevant details right on the dashboard. They also have a mobile app, so you can check the status of your money on your phone whenever you want.

If you want a full, detailed walkthrough of each screen and step, I recorded the entire process in the video at the top of this post.

Get started with Connect Invest

The biggest drawbacks and risks

Let’s talk about risks, because every investment has them, and this is no exception.

Your money is locked in for the term you choose. Whether it’s 6 months, 12 months, or 24 months, you’re committing to that timeline. If you need full liquidity at all times (meaning you want to be able to withdraw your money at any time), this is probably not the right option for you.

This is not FDIC insured. Unlike the money in your savings account, there is no federal insurance to back your investment here. There’s a little more risk on the table than with a traditional savings account, but it comes with the tradeoff of a significantly higher return than the disappointing interest your bank is probably paying.

The main risk is loan default. If a borrower defaults on their loan, that could affect their returns. Connect Invest mitigates this by spreading your money across multiple projects instead of putting everything into one. These loans are secured by real estate and, historically, only a small percentage of projects have had problems.

In fact, Connect Invest has never failed to make a payment to an investor since it began operating in 2010. That doesn’t mean it could never happen, but that’s their track record so far. If a large number of its projects failed at the same time, returns could take a hit, but historically that hasn’t happened.

This is not designed to generate large profits. If you’re looking to double your money quickly (like you could with a land swap, for example), this isn’t it. Returns are modest and predictable by design. That’s the point.

One more thing worth noting: when you sign up, you will need to confirm that your investment does not exceed 10% of your net worth or annual income (whichever is greater). This is actually a good rule of thumb. You never want to put everything you have into one investment.

Should you invest with Connect Invest?

I’m not here to give you investment advice. I’m here to share my experience investing with Connect Invest so you can understand the ins and outs of how it works in the real world.

Here’s my honest opinion on the question “who is this for?”

Connect Invest could be a good option if:

- Because a truly passive income that requires no time or energy from you after the initial investment.

- Prefers predictable and consistent returns to the rollercoaster of the stock market.

- Because exposure to real estate without the headaches of owning, managing or selling properties

- You agree to have your money locked in for a fixed period

- Value consistency and stability rather than chasing a huge lead

Connect Invest is probably NOT a good option if:

- You need full liquidity at all times

- Because direct control over individual properties

- Are you chasing rapid growth or trying to double your money quickly?

- You’re not comfortable with any level of risk beyond a standard savings account.

I’ll be the first to say that there are many ways to make a lot more money in real estate. But they typically require a lot more hands-on work, knowledge, and sometimes more risk on your part. The appeal of something like Connect Invest isn’t in the high returns. The appeal is that it requires nothing on your part beyond the initial dollars you invested, and you’ll see those returns start coming back almost immediately.

Get started with Connect Invest

Whether you invest with Connect Invest or not, make sure everything you do aligns with your financial goals and risk tolerance.

Stay curious, stay informed, and as always, invest wisely.