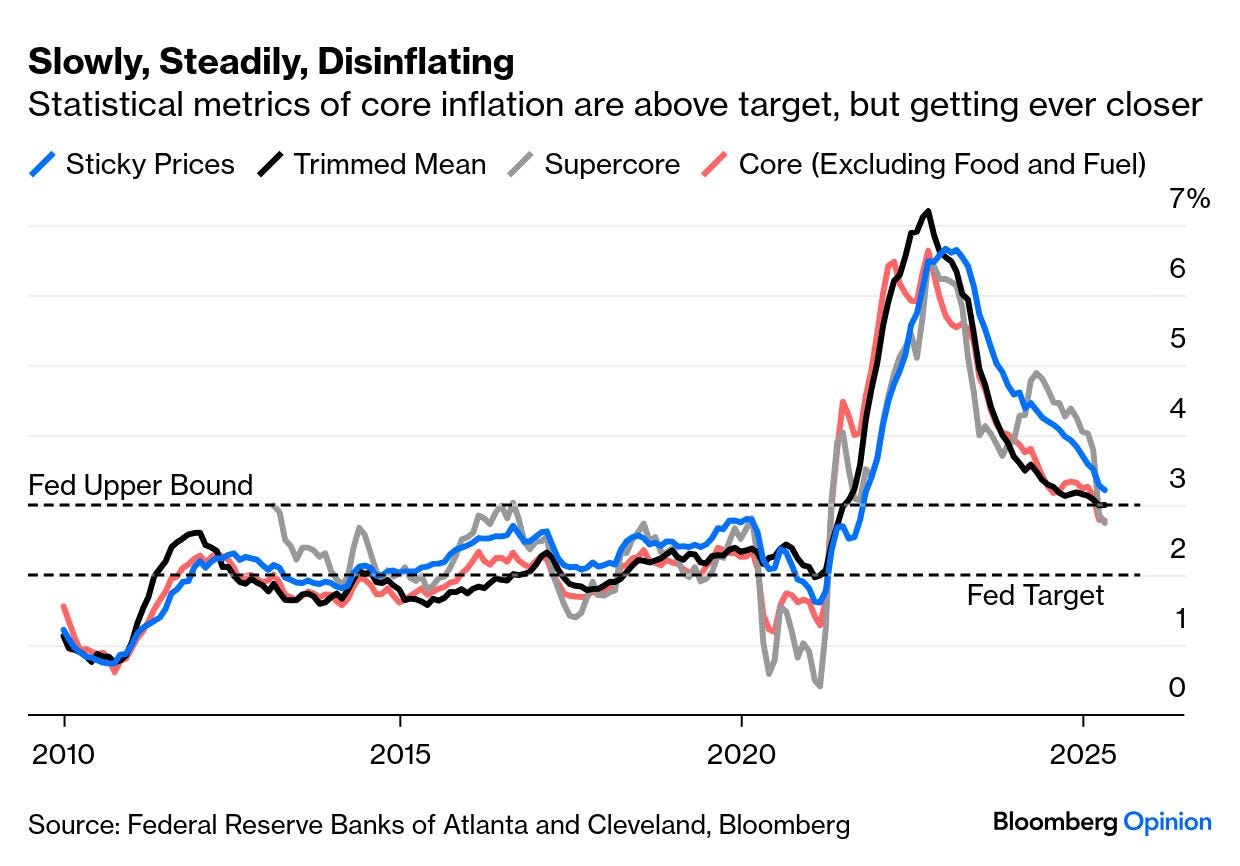

Remember the days where everyone was laser focused on inflation data? Well, CPI is boring again. Many of the Fed’s favourite measures of inflation have normalized to the Fed’s target range. (John Authers)

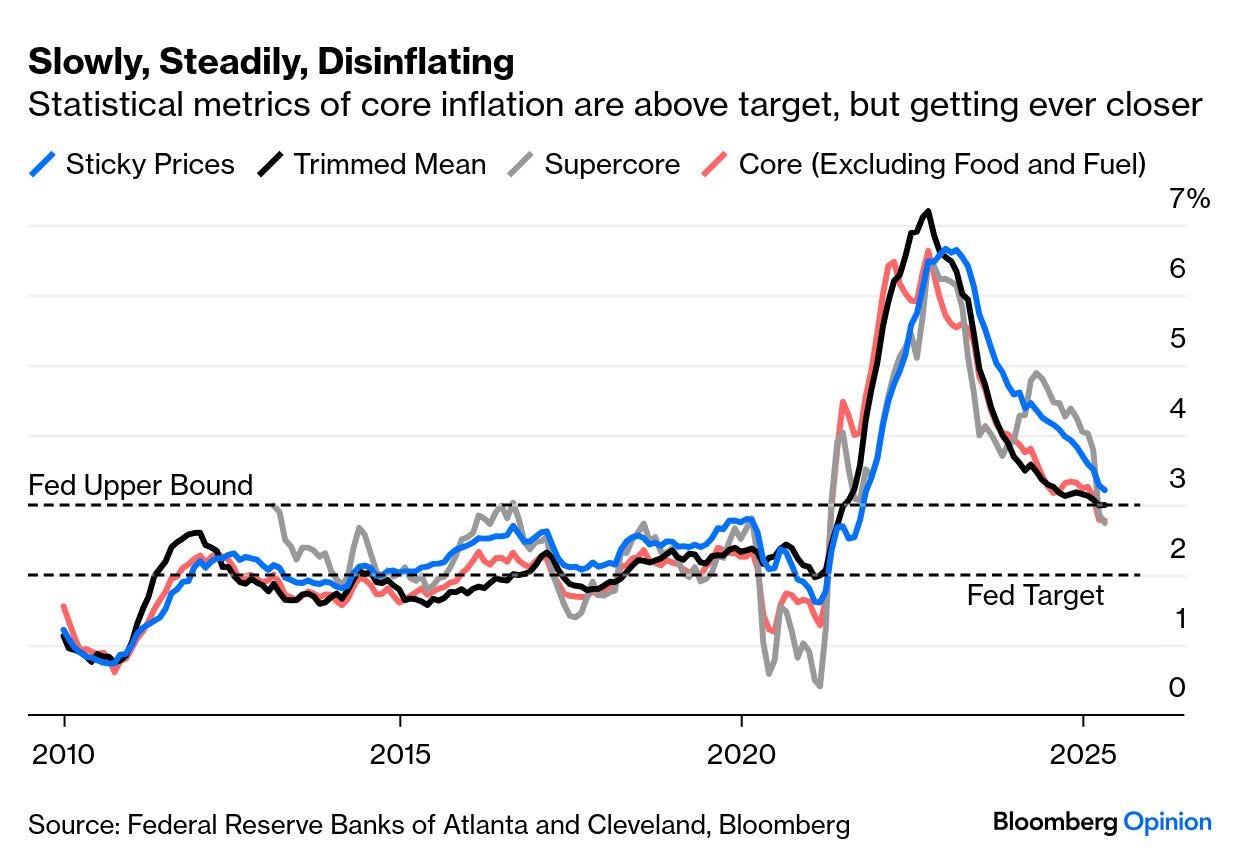

It has happened before it could happen again. Worst 20 year real return periods for the 60/40 portfolio across geographies. A set and forget 60/40 portfolio will be insufficient to protect wealth across all regimes. (@MikeZaccardi)

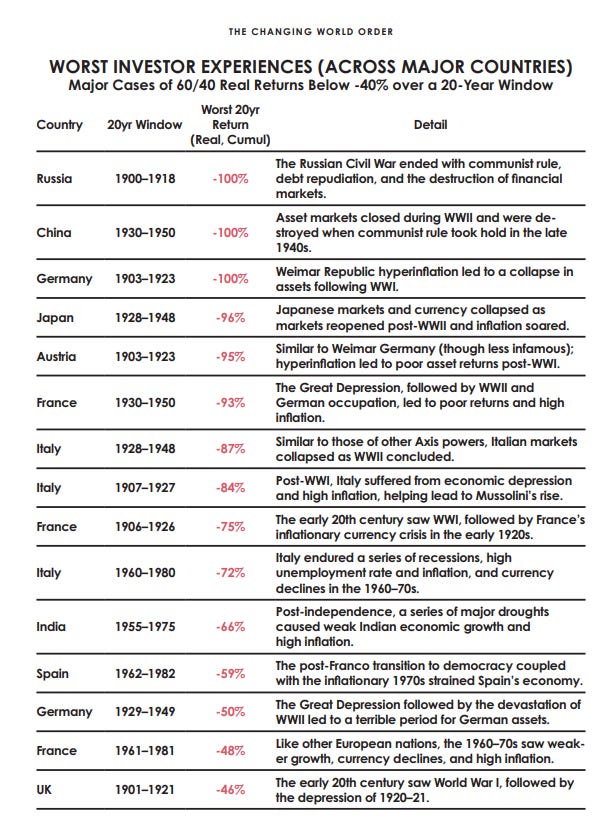

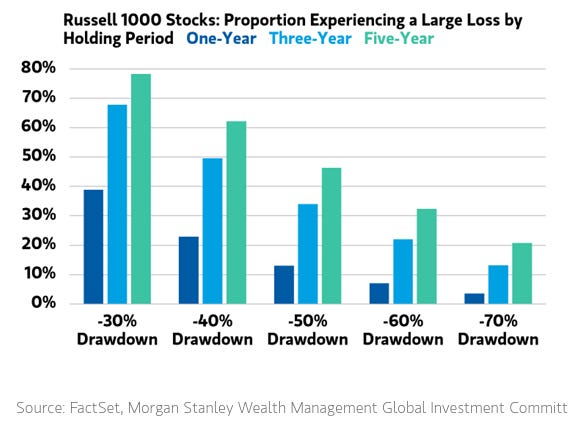

I’ve seen it many times, wealth is built through a concentrated position but concentrated positions will be exposed to drawdowns. Over a 5 year period, 60% of stocks in the Russell 1000 have a 40% drawdown or more. (@MebFaber)

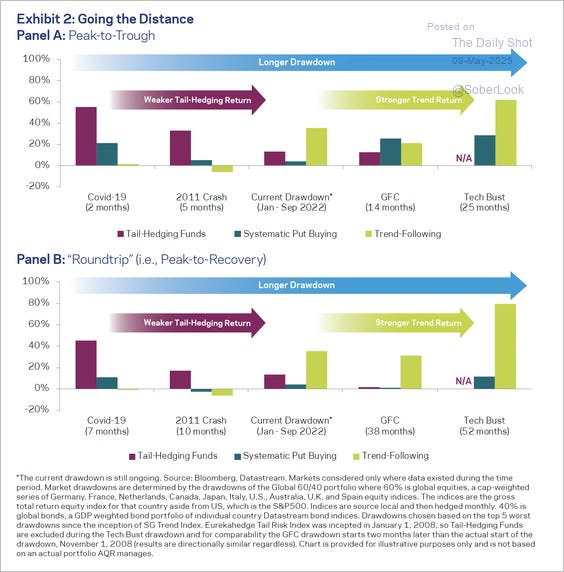

Not every drawdown is the same and this means different defensive strategies will fare better or worse depending on the type of drawdown. I saw a few tail hedging strategies that were down in April despite the violent but brief sell off. (The Daily Shot)

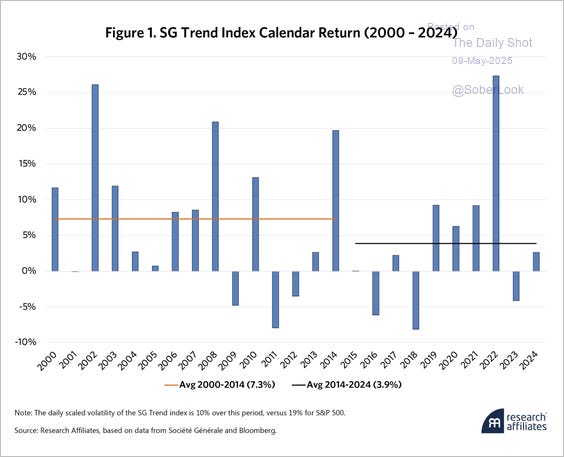

Trend following is/was once considered a diversifying strategy to equities and bonds but the performance has been disappointing over the past decade. Did success attract capital that diminished returns? (The Daily Shot)

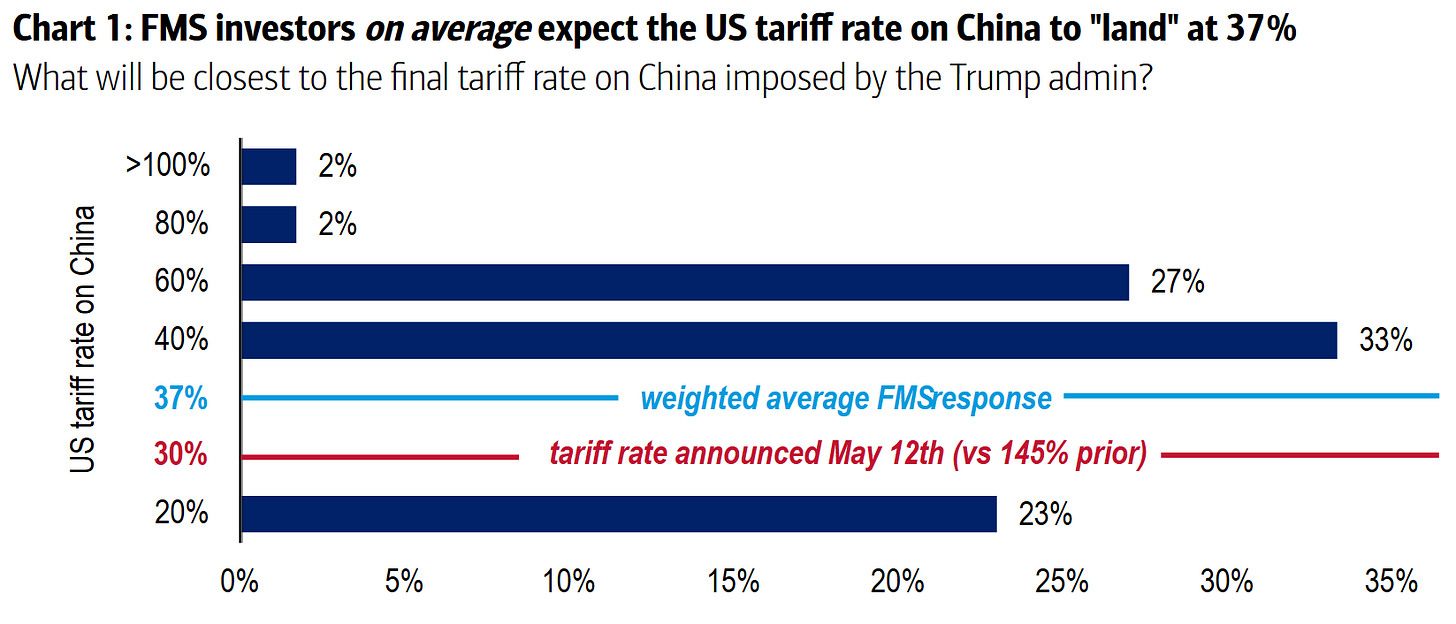

Fund managers expect on average the US tariffs on China will land at 37%. (BofA)

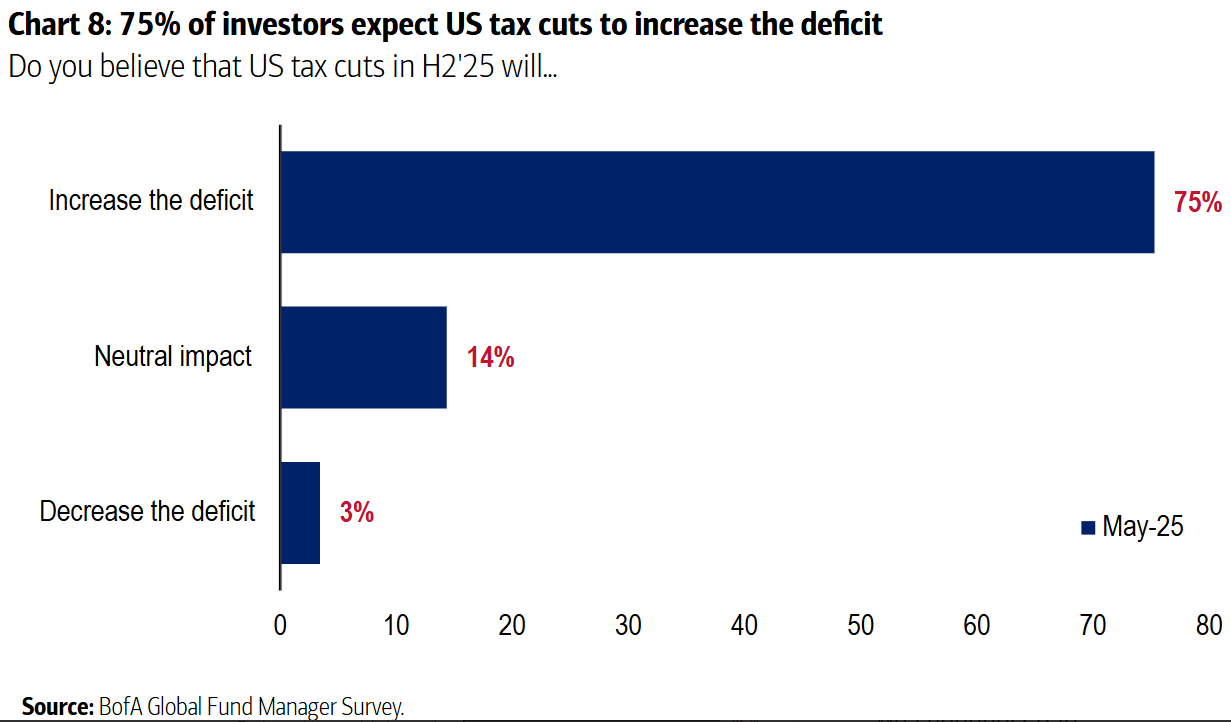

People have given up on budget discipline. 75% think Trump’s tax cuts will make the deficit worse. (BofA)

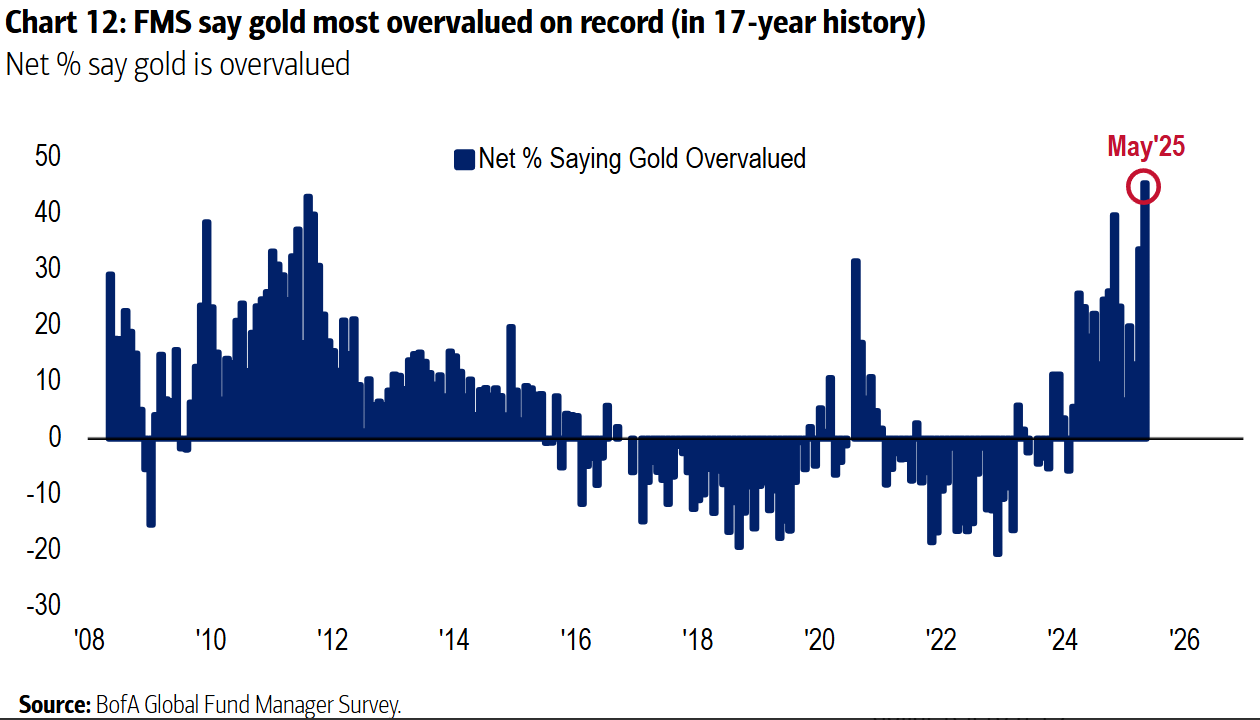

Fund managers see gold as most overvalued in 17 years. (BofA)

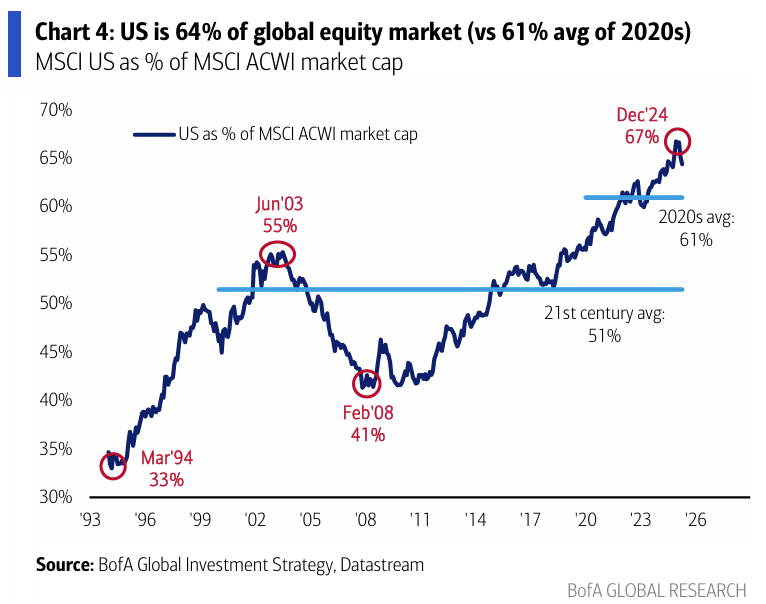

US exposure still makes up 64% of global equity markets. US equities are one of the largest most liquid positions of investors globally. Hope we don’t find out what happens when flows reverse. (BofA)

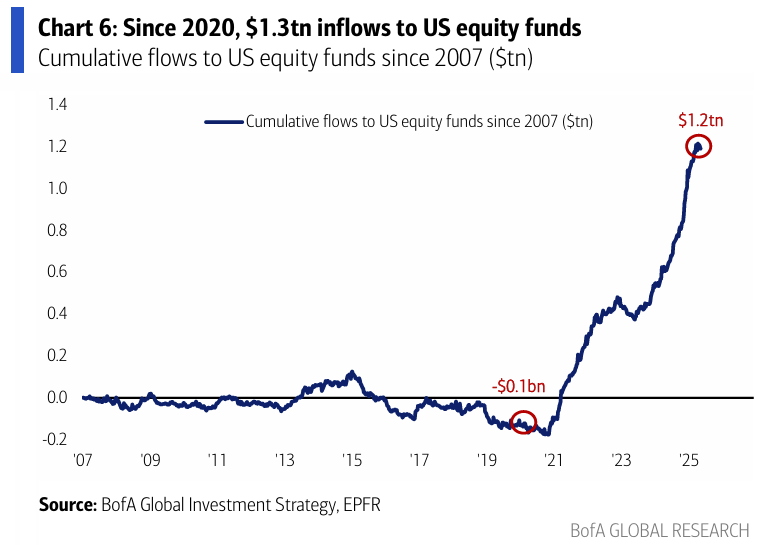

Since 2020, over $1.3T has been invested in US equity funds. I struggle to reconcile neutral flows for a decade, transitioning to the explosive flows in the past couple years. (BofA)

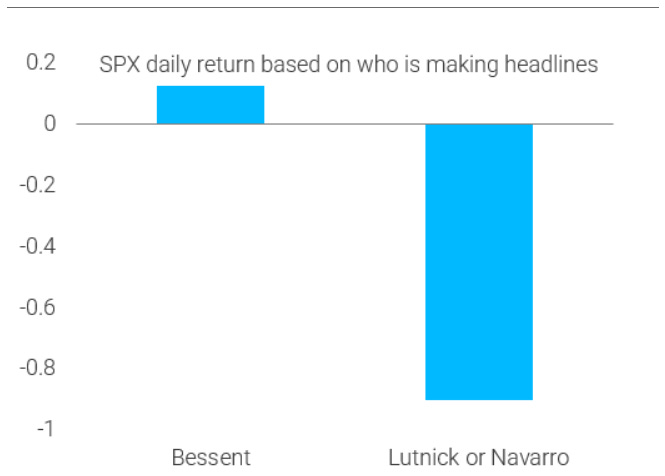

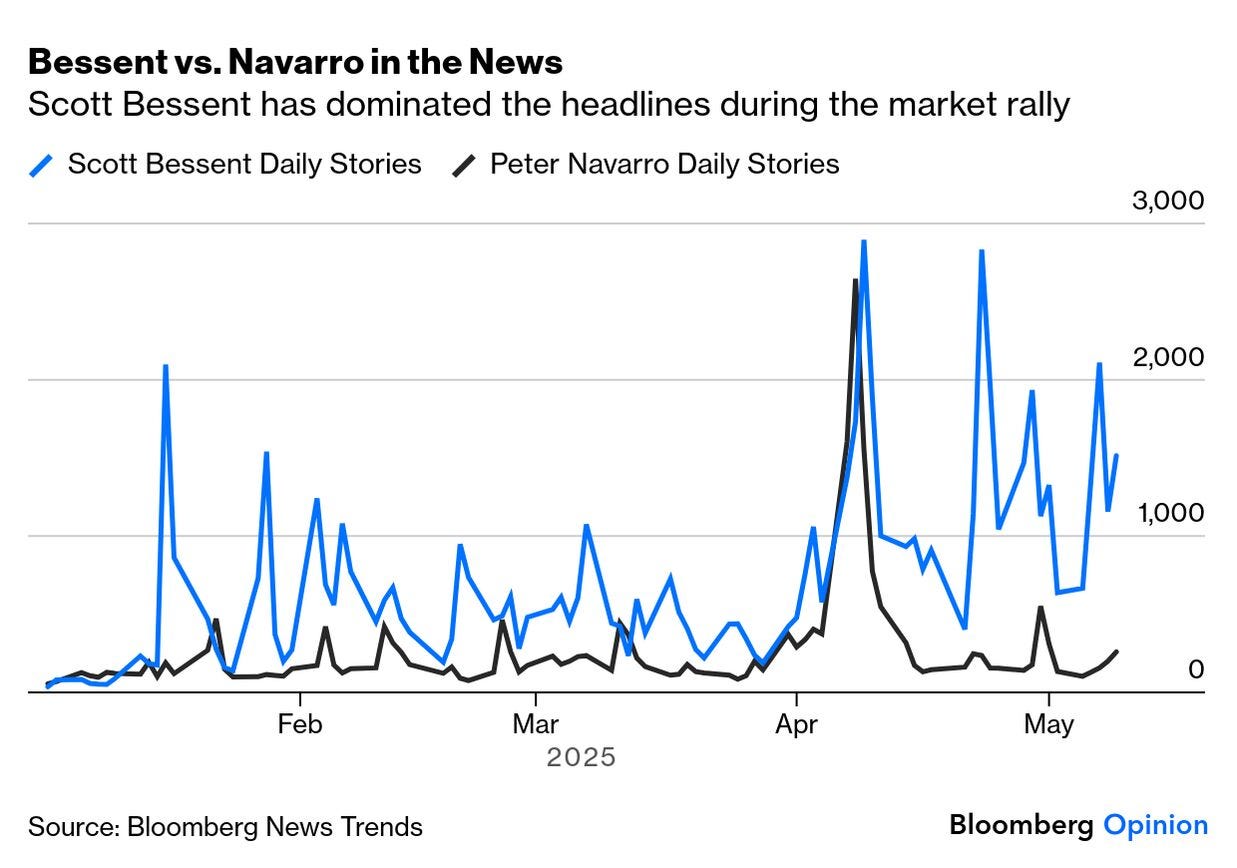

Trump has figured out that Bessent is much better for markets than Lutnick and Navarro. (John Authers)

Navarro had his moment but that was quickly taken away after the market crashed and Bessent became the steady voice of reason through the volatility. (John Authers)

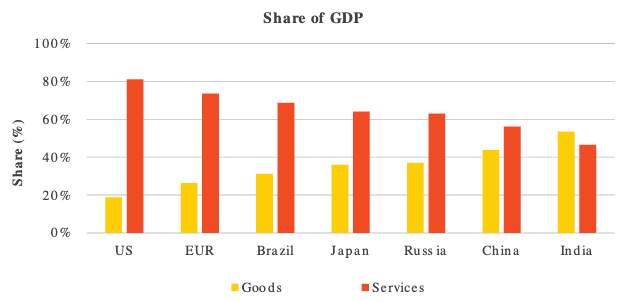

Worth remembering that the US is a service based economy and tariffs would only impact goods that are a much smaller portion of the economy. (Blackrock)

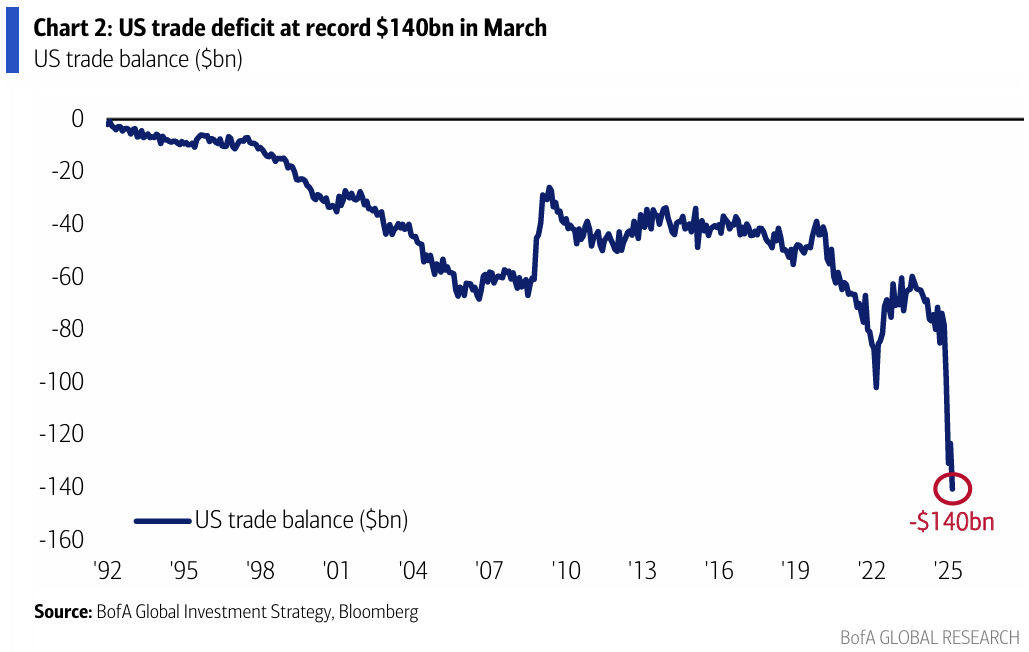

The US trade deficit set a record in March. (BofA)