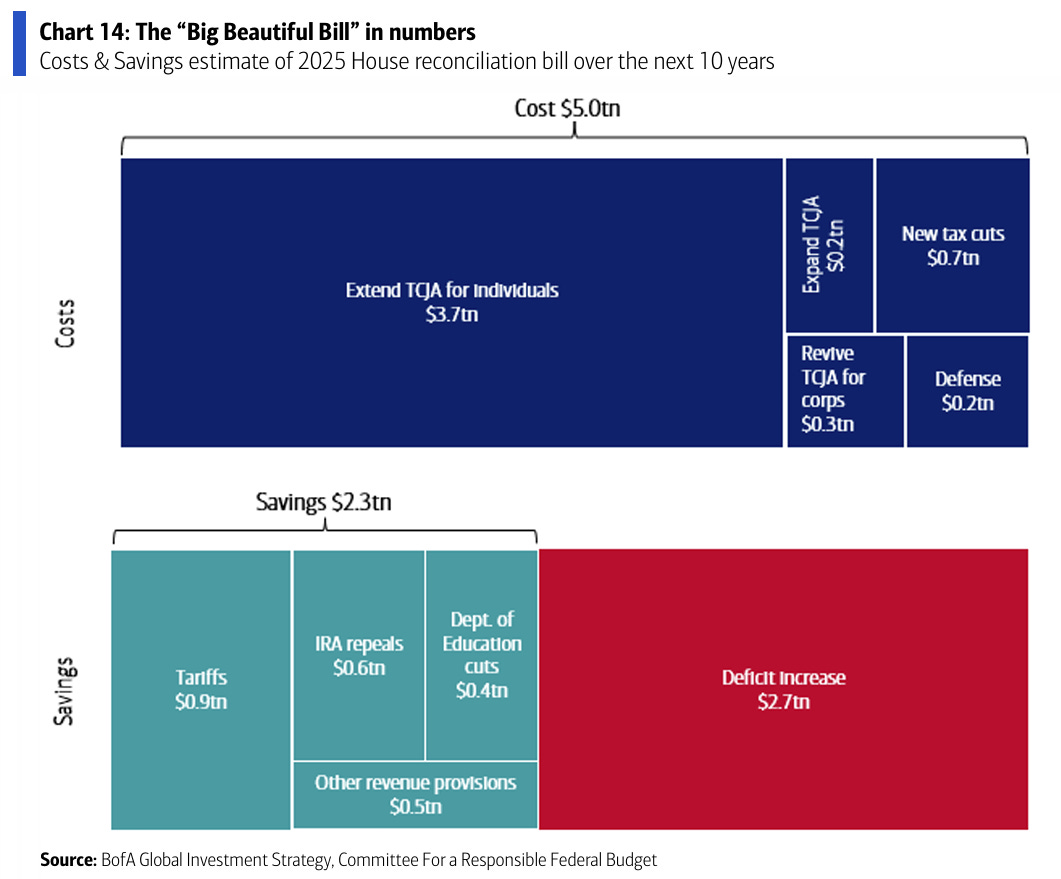

Global stocks rose on US-China trade hopes. Growth is slowing and disinflation remains intact. Late Friday, Moody’s downgraded the US due to rising government debt, raising concerns about its safe-haven status and pushing bond yields higher.

Federal interest payments are likely to absorb around 30% of revenue by 2035, up from about 18% in 2024 and 9% in 2021.

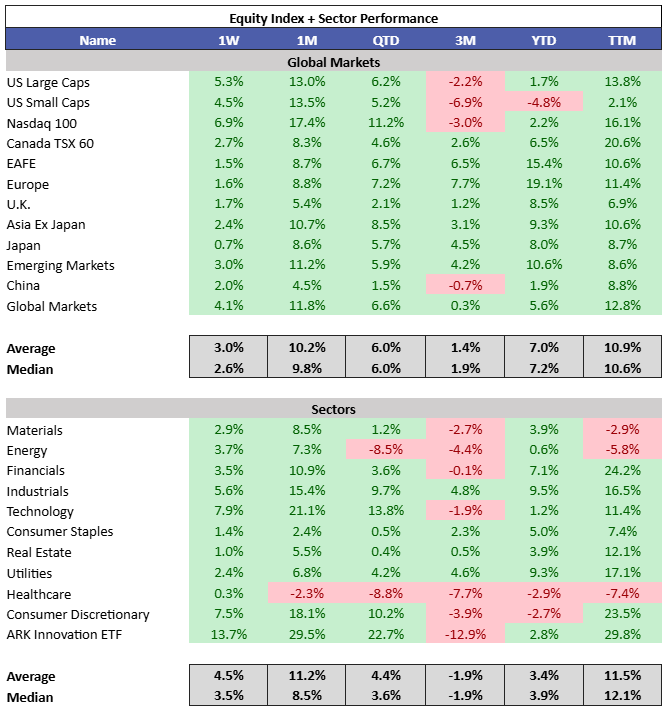

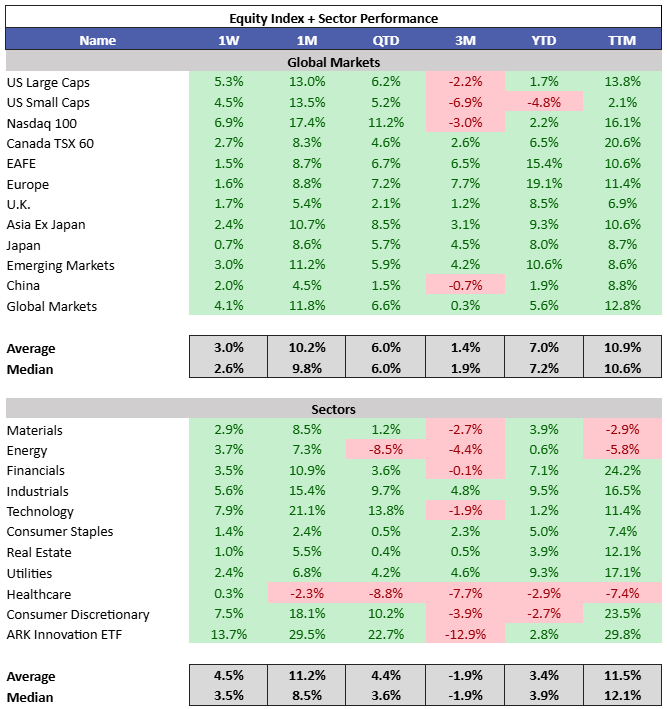

The S&P 500 is now positive on the year. Tech and Consumer Discretionary were the top performing sectors.

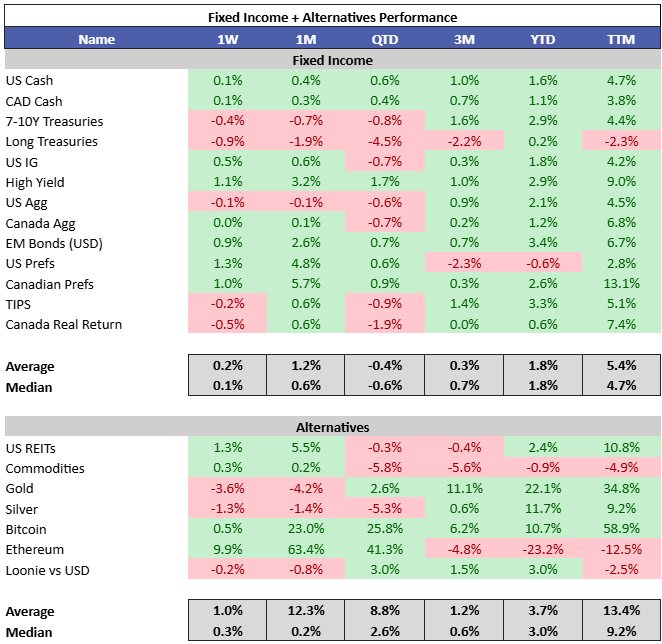

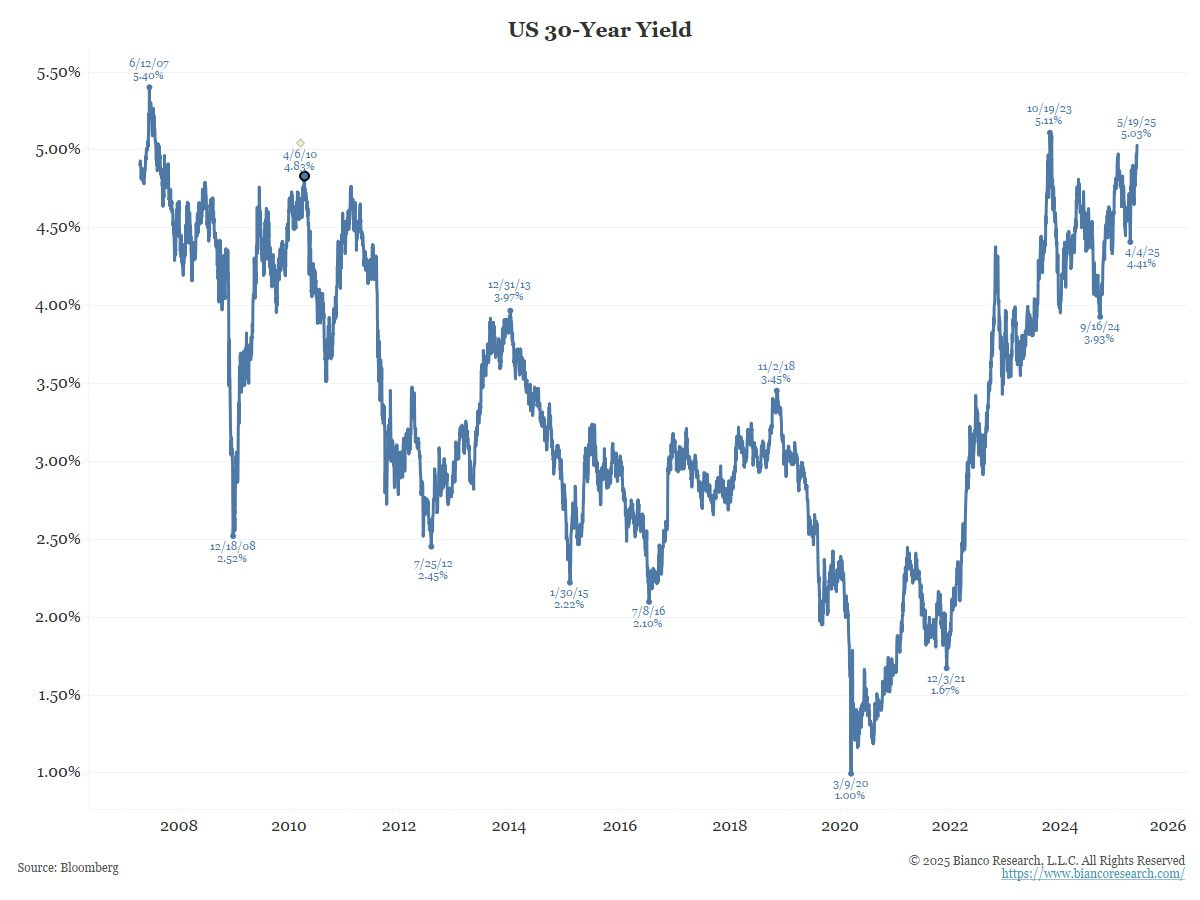

10Y yields were up 10 bps in the US and 2 bps in Canada, resulting in a mixed week for fixed income. Precious metals sold off as risk rallied. Eth continues to recover some of its losses YTD.

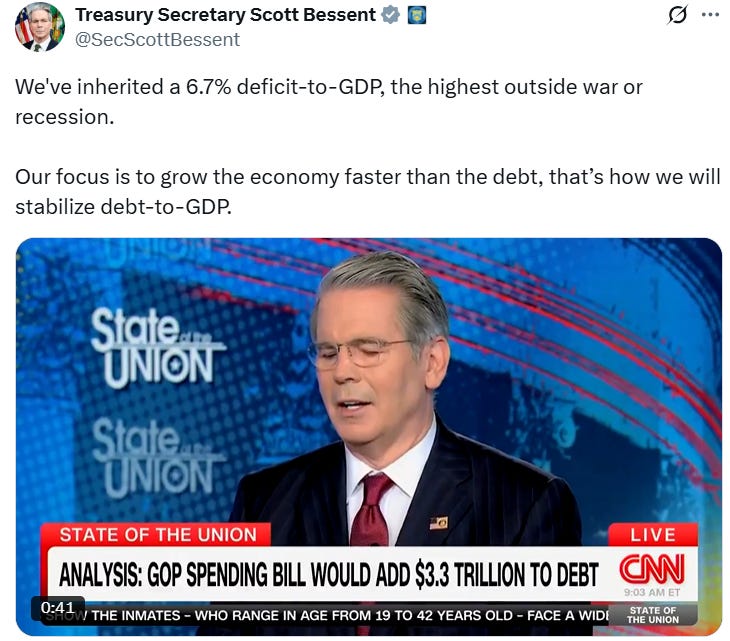

Bessent makes it clear his intention is to grow the economy faster than the deficit is rising. This is essentially the financial repression playbook; bad for bond investors. The next evolution is yield curve suppression. (link)

The US 30Y is approaching levels where it will start making headlines and could cause problems for equity markets. So much for this administration’s attempt to crash yields and term out debt. Bond market intervention may be next. (@biancoresearch)

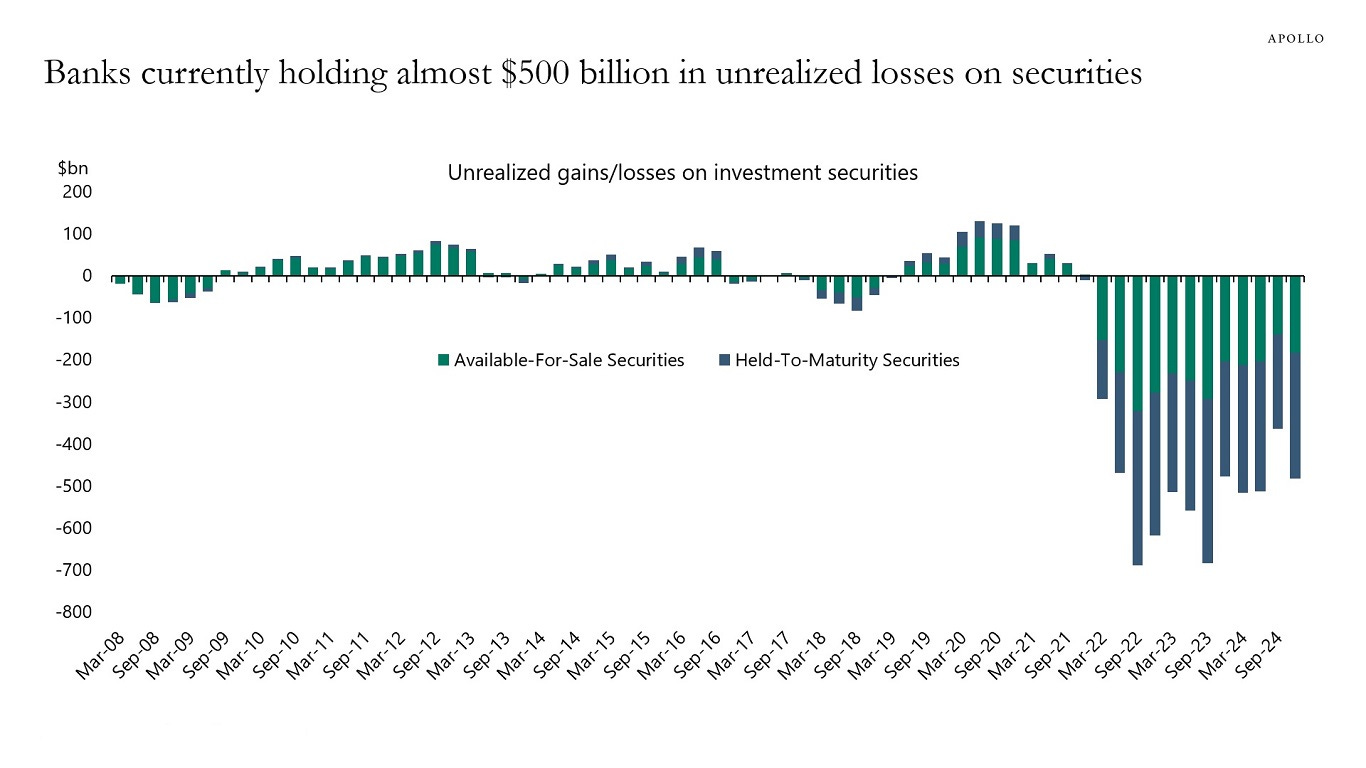

As long as yields remain high, banks will continue to hold unrealized losses on their balance sheets. (Apollo)

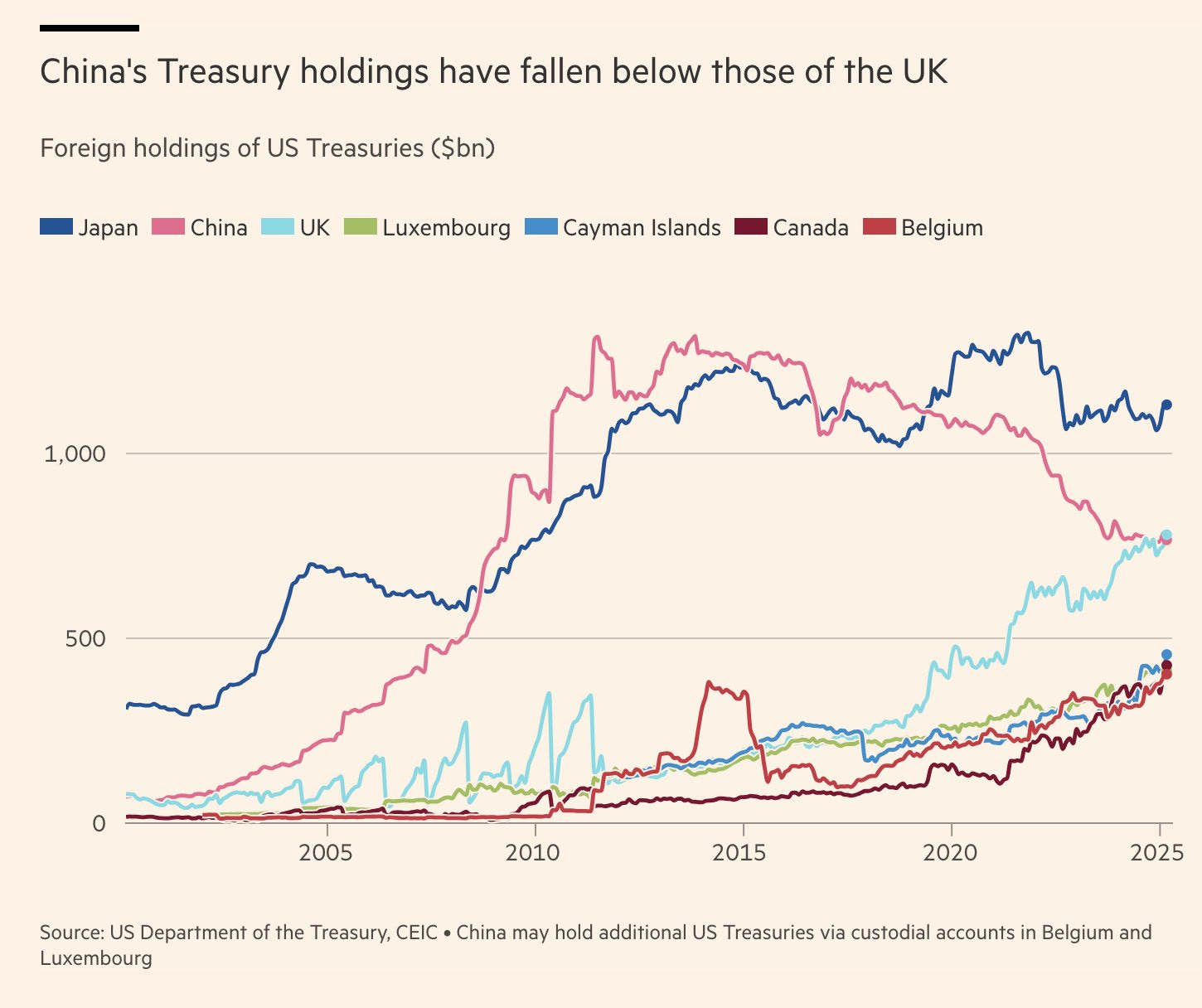

UK now holds the second-largest share of US Treasuries, surpassing China amid Beijing’s diversification efforts. (@Schuldensuehner)

The funding gap created by Trump’s “Big Beautiful Bill” is the likely catalyst for the Moody’s downgrade. (BofA)

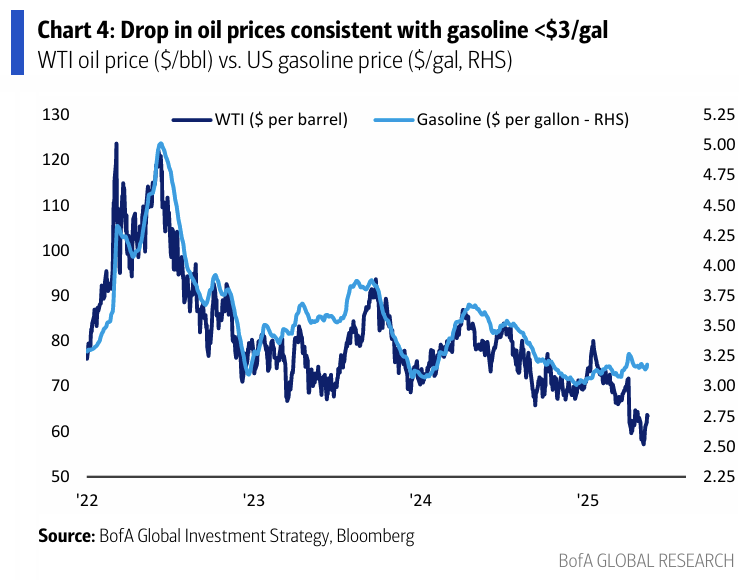

Good news for consumers, gas prices have room to fall. (BofA)

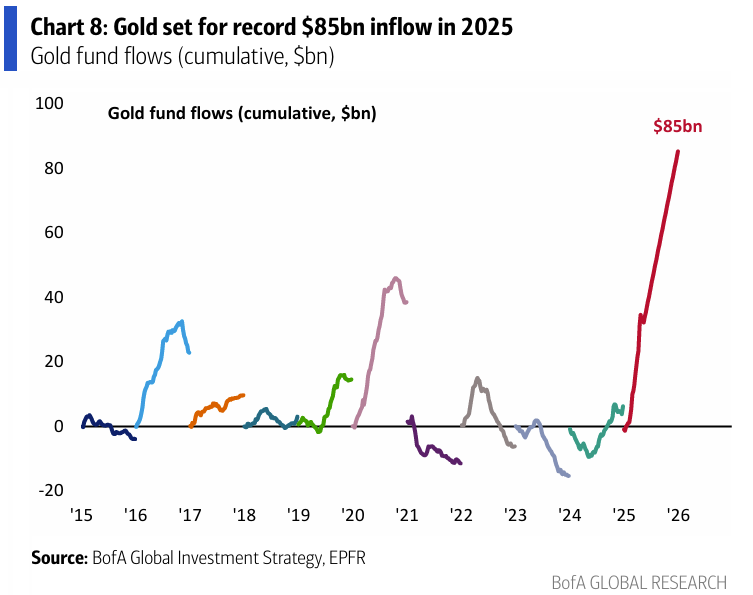

Gold fund flows are on track for a record year. (BofA)

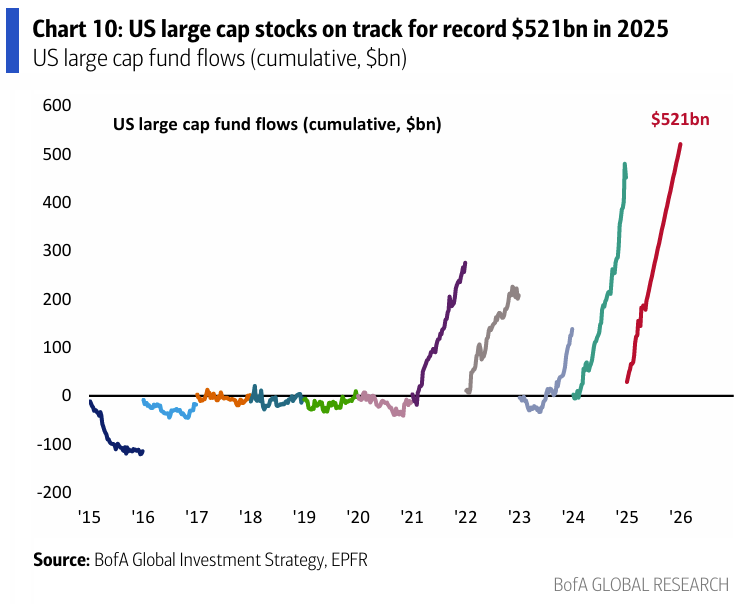

Despite the US stock market weakness, flows into US large cap funds continue. (BofA)

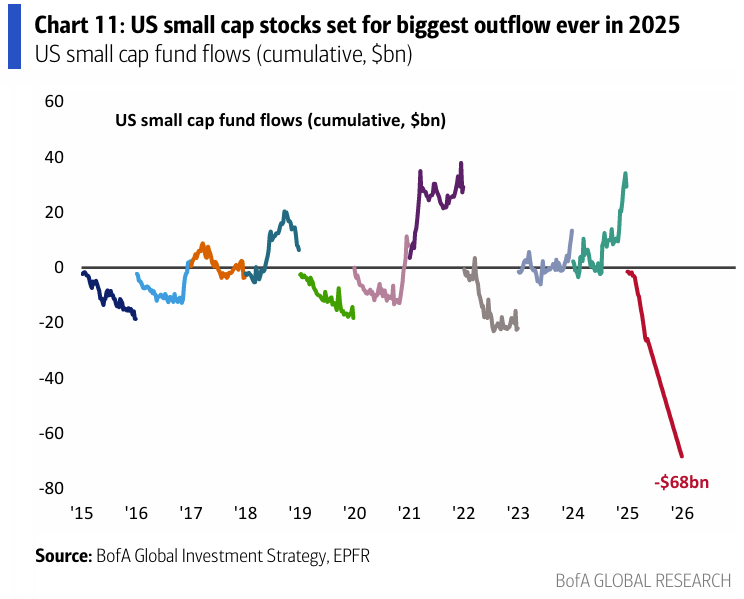

Investors have dumped small caps. (BofA)

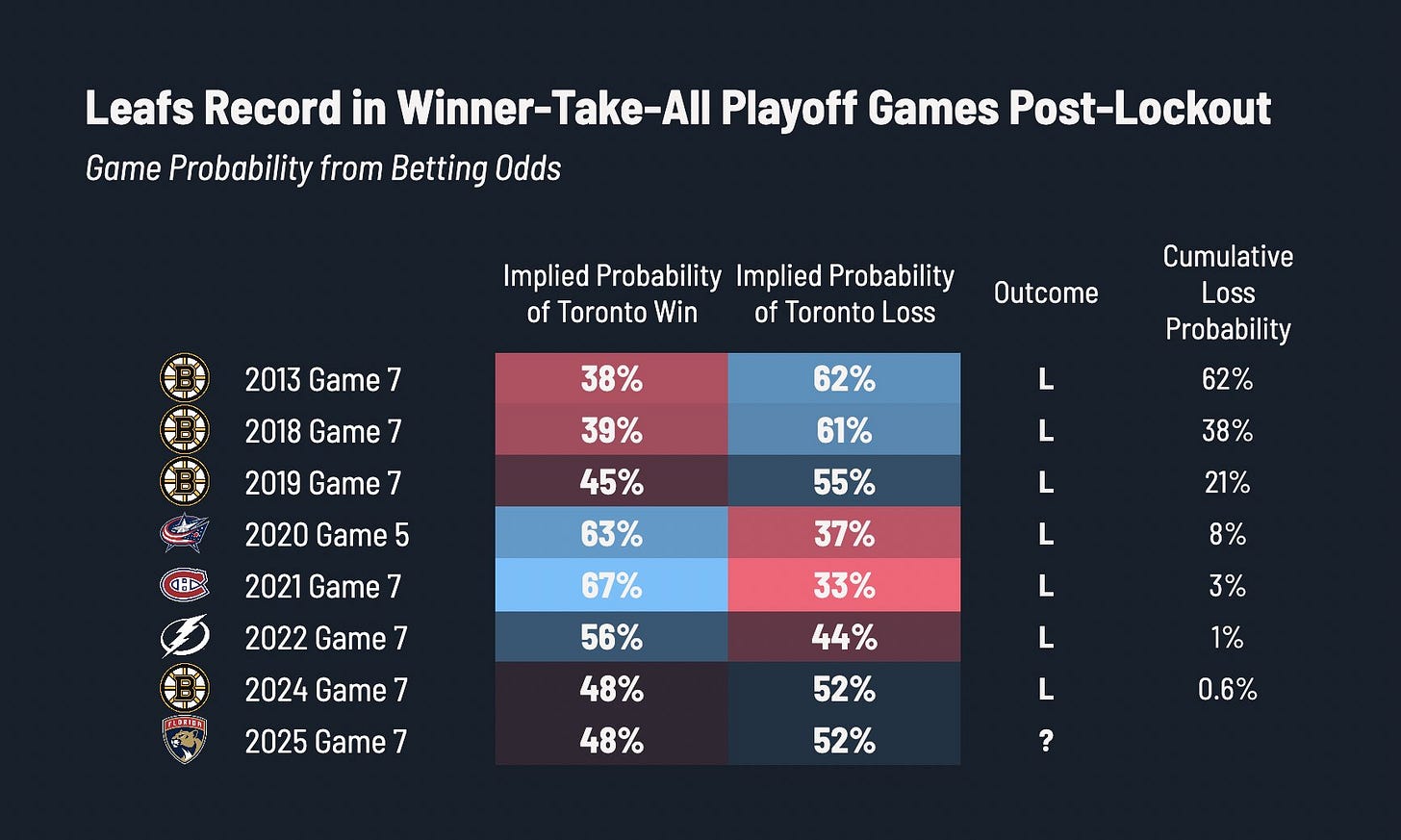

The Leafs have won 2 playoff series in the past 20 years, and have lost 8 straight winner take all games. Sad. (@JFreshHockey)