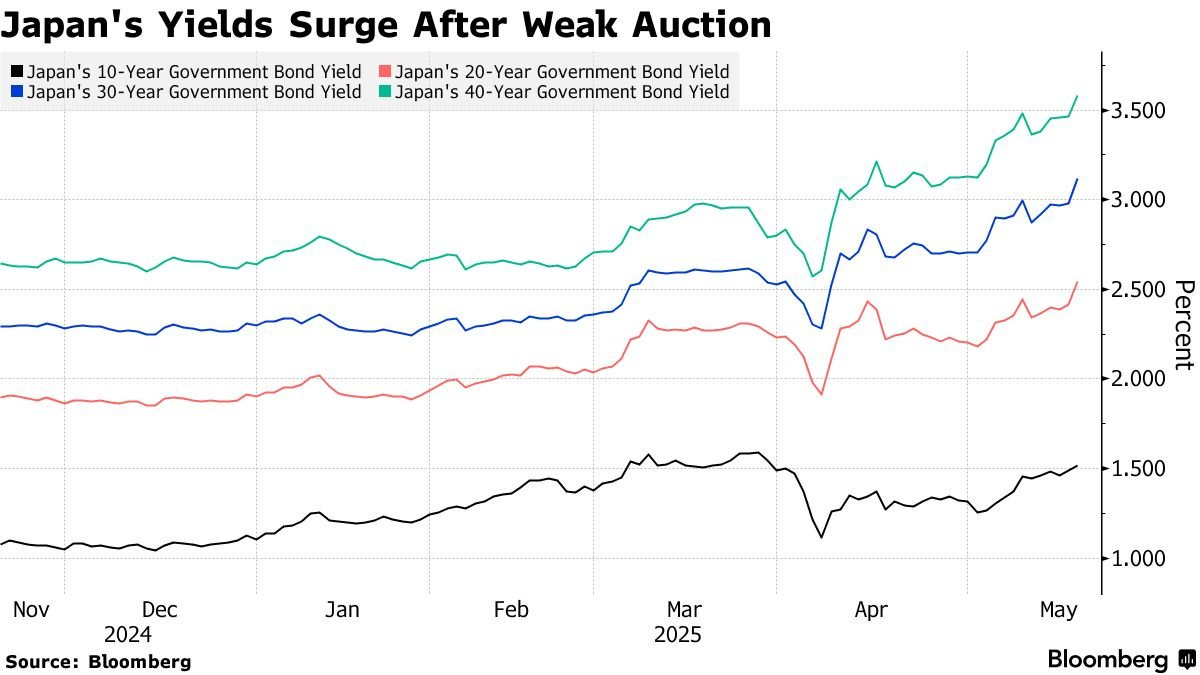

Japanese bond yields spiked following a weak 20Y bond auction, the worst in a decade. This propelled 20Y and 30Y yields to 25-year highs. A comparable surge last year triggered market turmoil due to fears of a Yen carry trade unwinding. (Bloomberg)

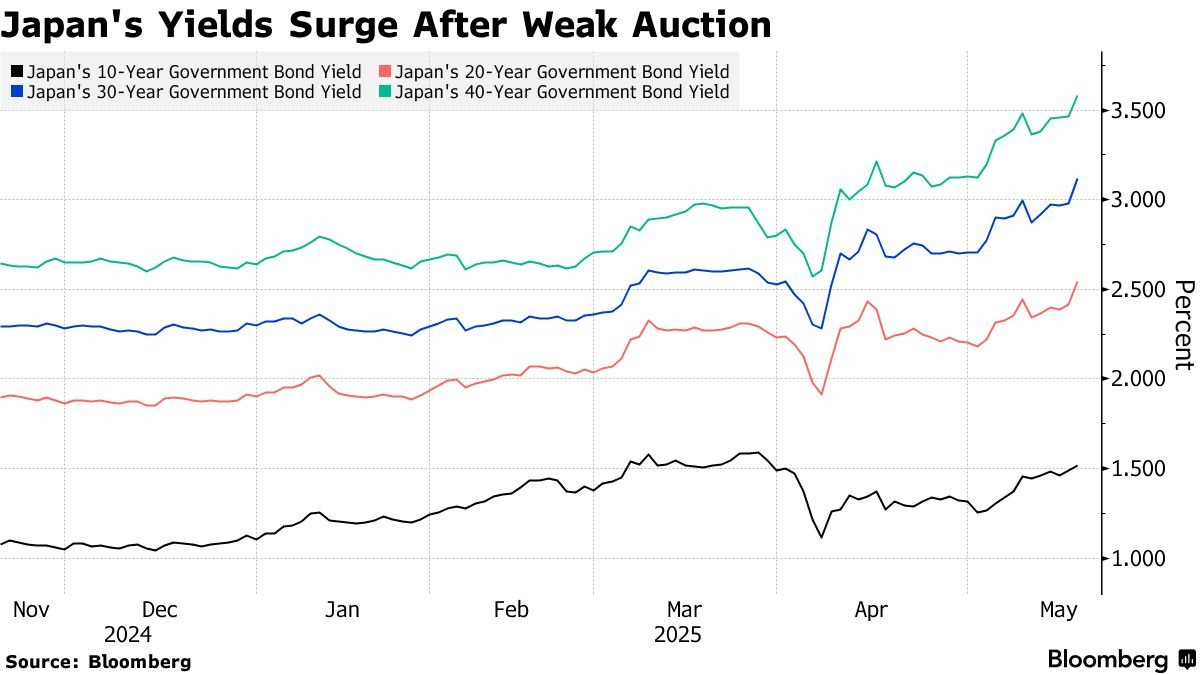

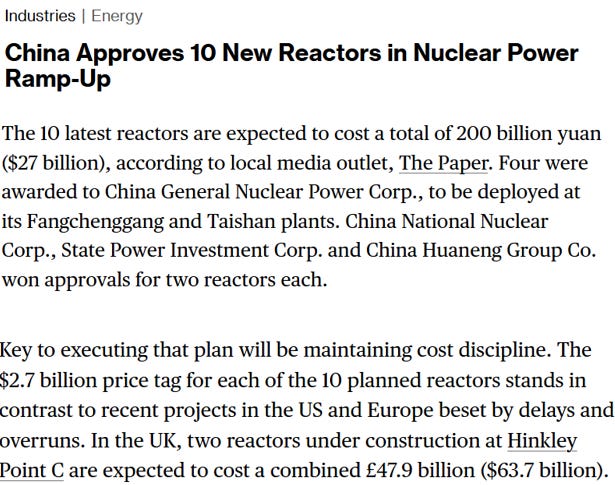

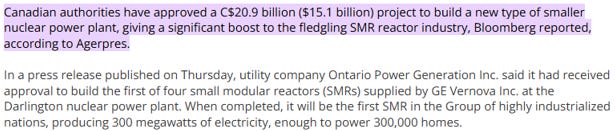

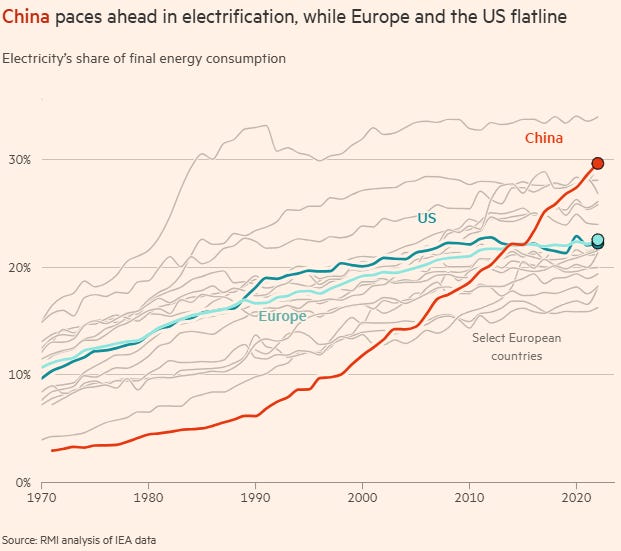

If you are a believer in EV dominance, AGI, humanoid robots, Bitcoin or economic activity being energy transformed, then the countries with cheap abundant power will lead the future. China is dominating electricity capacity construction. They are building at 3x the speed and a fraction of the cost of the West. (Bloomberg)

Back of the envelope math comparing the examples above and new “cutting edge” SMRs being installed in Canada. China has a big cost advantage.

-

China ~$2.7b/GW

-

UK ~$20b/GW

-

Canada ~$12.6b/GW

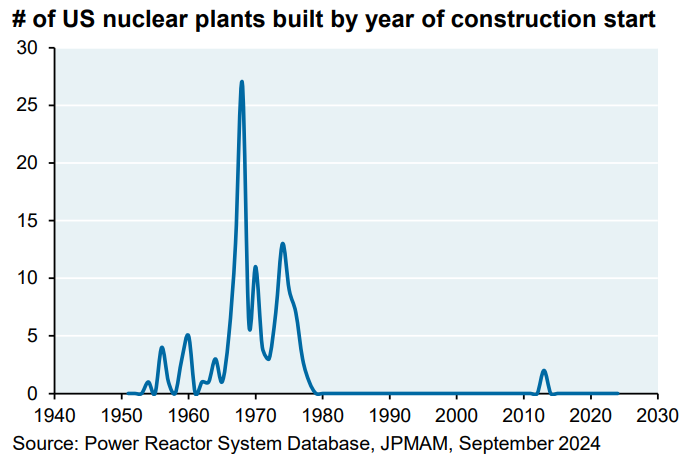

The West likely lacks sufficient trained workers and established supply chains to rapidly expand nuclear energy production to match China, even with adequate funding. Decades of investment in human capital and infrastructure would be required. (JPM)

China is electrifying their energy consumption at a rapid pace. (@Ole_S_Hansen)

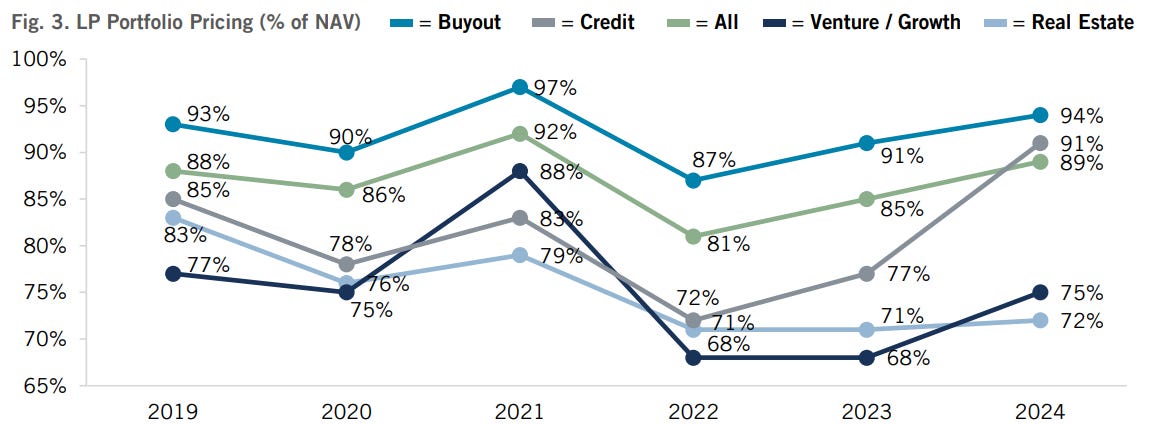

Real Estate and Venture remain the 2 most most stressed private asset classes. It makes sense as they are both the most rate sensitive. (Jeffries)

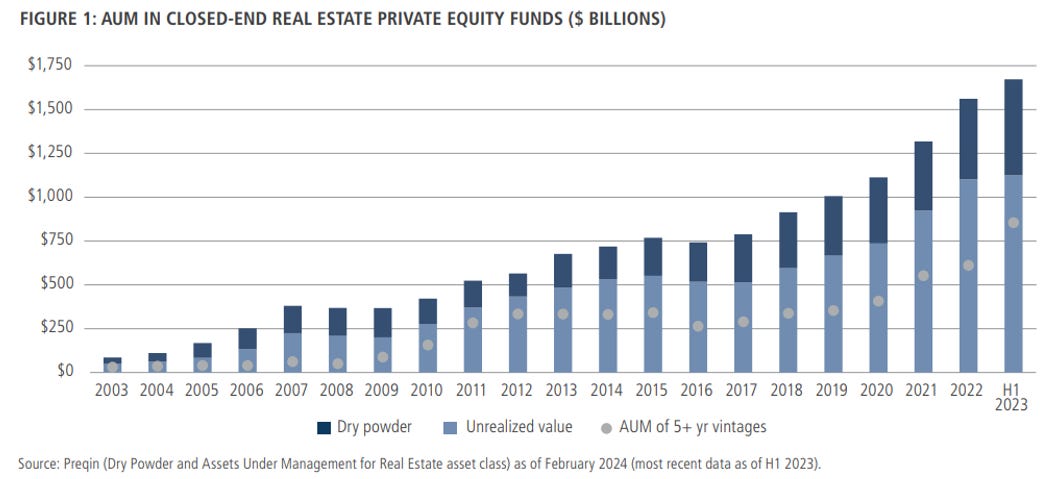

There is now likely over $1T of real estate NAV in vintages over 5+ years old. GPs will be looking for solutions with rates remaining elevated and with that could come opportunity. (NB)

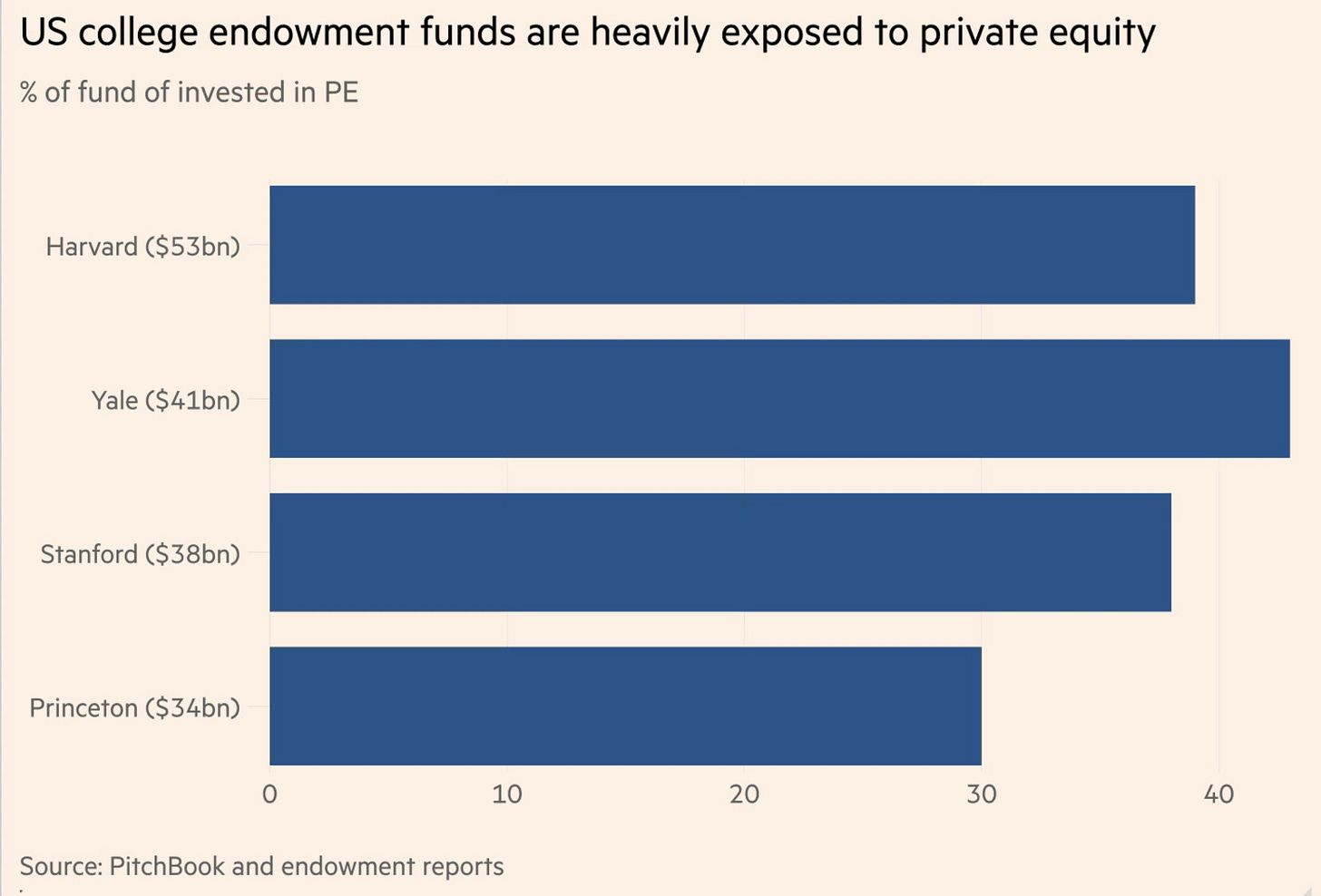

PE distributions have declined significantly, from 29% of NAV between 2014 and 2017 to just 11% last year. Endowments are accelerating sales in anticipation of potential tax increases, potentially from 1.4% to 21%. (@TidefallCapital)

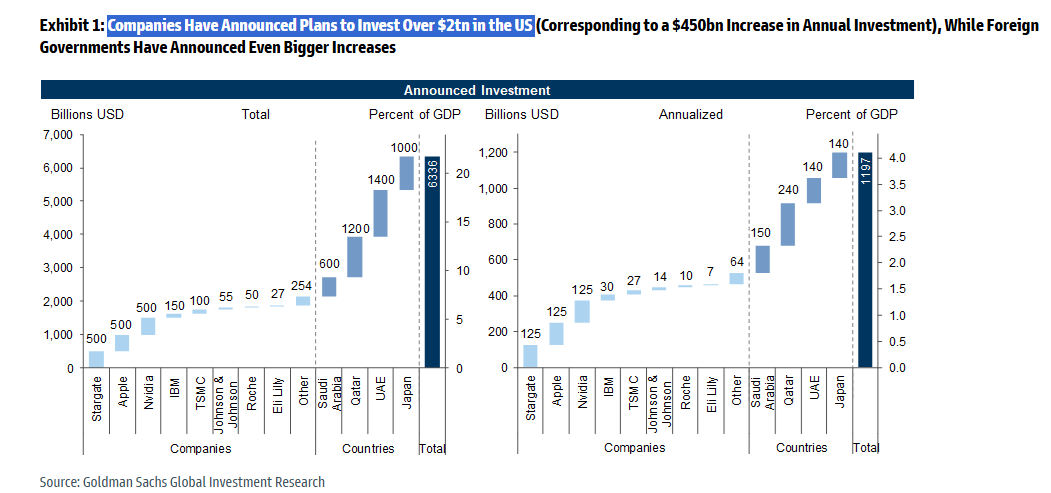

Corporates have announced plans to invest over $2T into the US. (@MikeZaccardi)

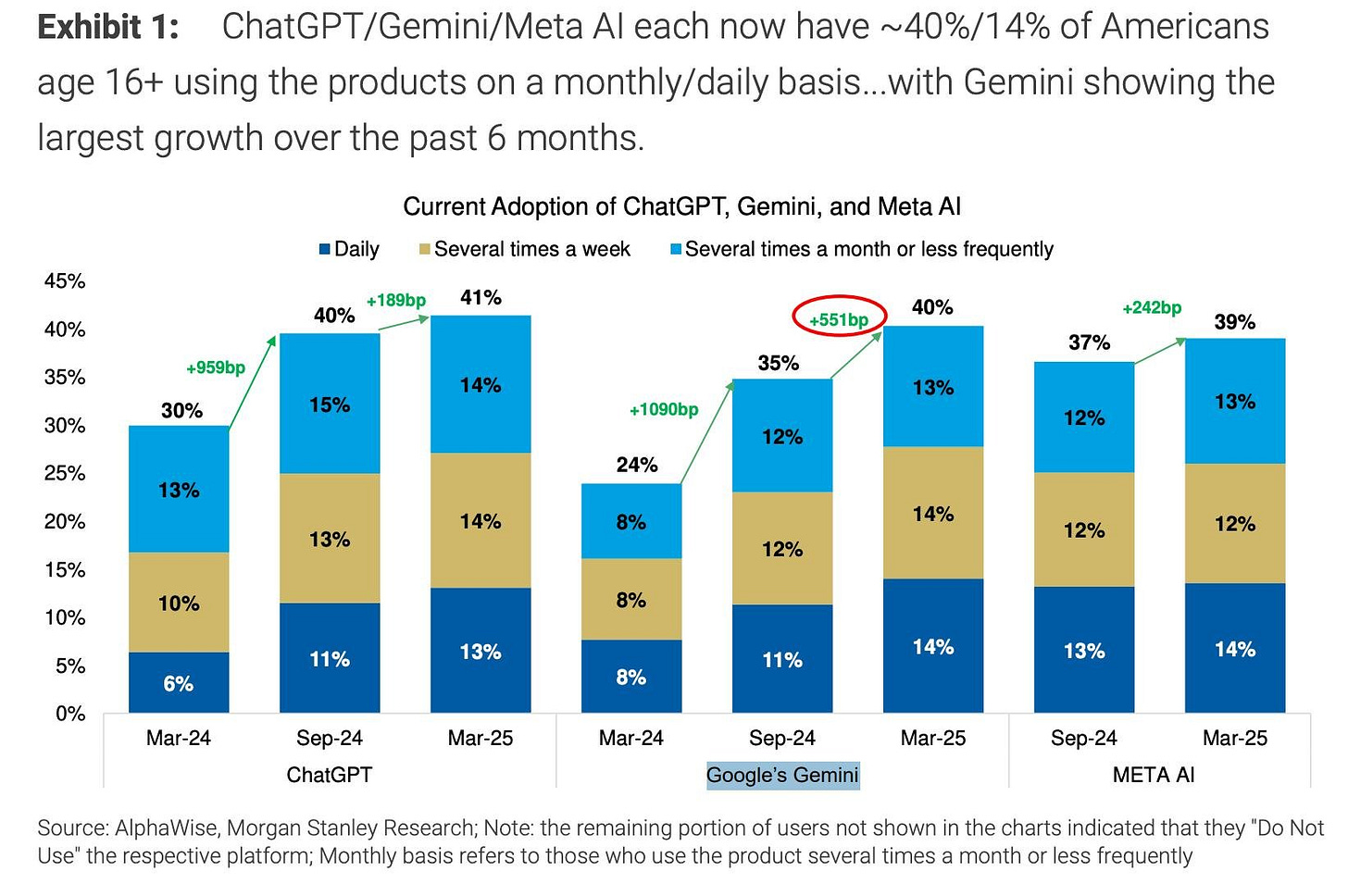

Google’s Gemini is rapidly catching peers from an adoption perspective.(@Jukanlosreve)

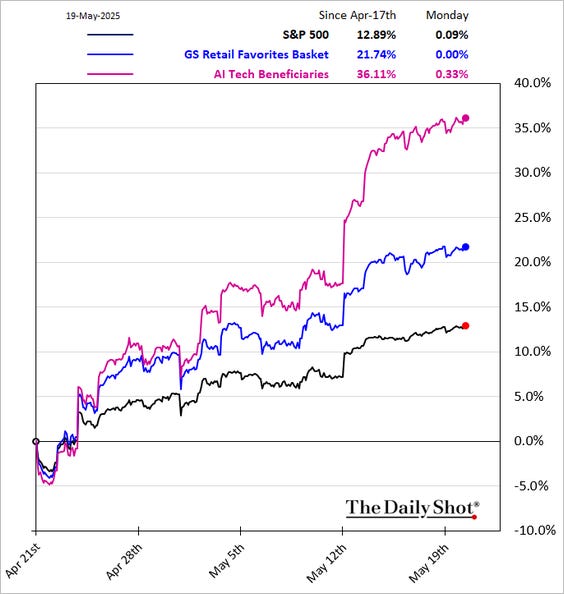

AI as an investment theme is back! (The Daily Shot)

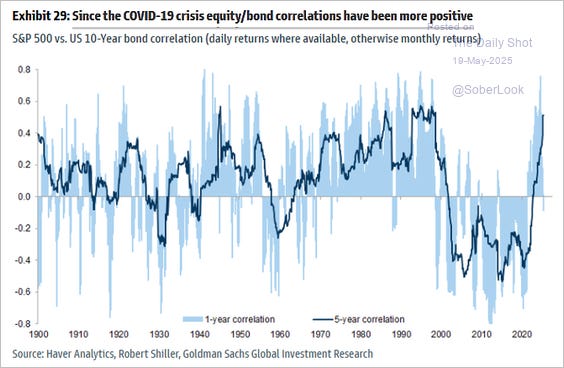

Equity bond correlations is signalling a new regime. (The Daily Shot)

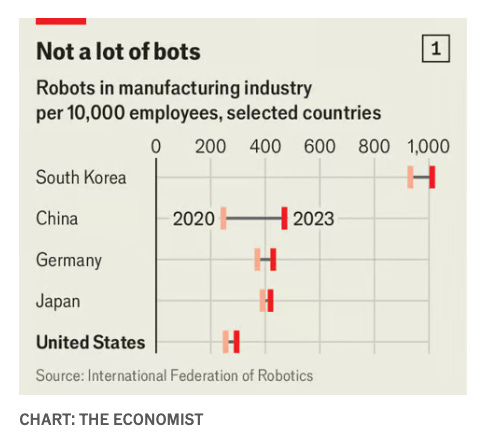

Asian countries lead manufacturing automation. (The Economist)