In what I am thinking: He Complete geographical reversal If the residential demand from Covid and why each assumption we made about “hot markets” of 2020-2022 is now a liability.

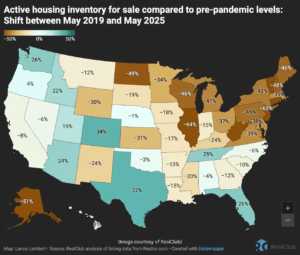

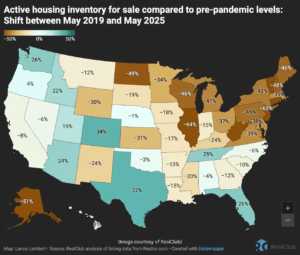

The data is becoming Impossible to ignore. Texas, Florida, Arizona, Colorado and almost all markets outside the west and northeast that exploded Covid duration now Massive housing inventory accumulations and price pressure down.

We are not talking about a minor correction. We are witnessing a fundamental change That is turning old boom markets into buyers.

The great geographical investment

Here in Austin, I am seeing this first hand, where they have collapsed 20% since mid -2022 – The greatest correction throughout the country (and rentals have fallen 20% at the same time, brutal for investors).

The rental property of my next neighbor (a ~ 2000 square feet SFR that bought in 2022) has been sitting Vacancy for most of this year.

This question $ 3,000 per month While the market rate has fallen to $ 2,400.

Instead of adapting to reality, they remain for the price of 2022. While writing this, the house remains empty.

(And I thought I was stressed when dealing with that Tennessee auction situation)

Austin’s accident: a real -time case study

While this scenario takes place in Each market That saw an explosive growth of the Covid era, let’s see a case study near my hometown:

A land investor sent me a portfolio agreement: 29 buildable lots approximately 90 minutes north of Austin, each property between .25 and 0.5 acres, with Complete public services. It is part of a narrower subdivision where the developer was survived and is trying to dump the inventory.

This is where the numbers become unpleasant:

The 2,500 square feet houses newly built in that area are listed in ~$ 350k And have the leg sitting on the market to Approximately one year.

The only residential sales in the last 12 months were 50 -year properties Moving for $ 115-120Kplus a premium house with a pool that managed to close in the mid -300.

The $ 10K lot offer: when standard assessments are broken

Using the standard rule of 10% (Earth quotes to ~ 10% or subsports of $ 400k housing values)You would expect these lots to get around $ 30-35K each.

But when the inventory does not move to $ 350k, That rule becomes Meaningless.

My evaluation? The lots sent For me (it must or also affected by an flood zone) could be exchanged to another developer for ~$ 10K each If the buyer can acquire them to $ 5,000 per lotCounting the lack of demand and lower characteristics.

That is a 66% discount (and 84% discount to build a margin for a land investor) of the “expected” market price (That a local real estate agent had the agiduga to cite). Even so, it reflects the reality that the inventory simply does not move in these markets.

Survival strategies: how to pivot in the new reality

There are some key lessons of this market investment:

The geographical assumptions of 2020-2022 are now liabilities. The hot markets three years ago are today’s danger zones. What promoted demand then? (Remote work, lower housing cost, low rates) He has made a complete 180. Prices must go down.

When the residential inventory sits for a year, the price of the earth must fall dramatically. Standard valuation rules break down when the underlying market does not work. For filling areas, you may need 70%+ discounts Only to create movement, while being built on your margin.

New data tools are essential for geographical orientation. Intestinal feelings about “good markets” or trusting in past results will kill you. Monthly inventory trends and demographic data are now critical For serious land investors.

(I accredit Nick Gerli or Reventure Consulting for exposing this trend with processable data. I subscribe to your Reventing application$ 40 months, to verify any area for housing trends before financing agreements now. This is a suite for residential use, which is an important component or most land offers.)

Cycles require adaptation, not despair. Real estate are cyclic. Get used. Investors who survive and thrive are those who detect early changes (or not too late, at least) and turn their strategies accordingly.

If you house, you still realize, now you have done it. Several institutional investors with billions of dollars in the housing inventory also trapped in this surprise change and try to reduce their losses as quickly as possible.

===

Do you need reliable funds for your next country agreement? Severe terrestrial capital is actively looking for development and procurement projects of greater value. Our painful and revealing lessons of offers such as this property of Tennessee mean better proper diligence systems and less surprises for their projects.

Send your treatment!

P.S. Why the complete breakdown of this case study of 29 lots and my complete geographical analysis? Episode 160 or get serious (Listen on any podcast platform) Walk through each number and shows exactly how to identify these market changes before crushing their yields. Gross data on the new reality of residential demand. Without fluff.