What I’m thinking about: How a scammer walked into a US embassy in the Middle East with fake documents… and walked out with notarized closing documents for our Gulf Front deal in Florida.

We were literally an hour away from wiring $350K for a luxury infill lot when the title company canceled the insurance on the property.

When a “perfect” agreement began to show cracks: the problem of SIN

Let me paint you a picture:

Even in this tough market (and our general aversion to backfilling lots), the deal looked stellar. Conservatively valued at $700,000 (probably closer to $800,000), with a $350,000 contract.

The seller was Canadian and had owned the property since picking it up from a bank for $220,000 during the 2009 crisis (it had previously sold for $1.6 million in 2006, and that seller immediately defaulted). Story was found to be in financial trouble, and I personally reviewed every line of the salesperson’s call transcripts.

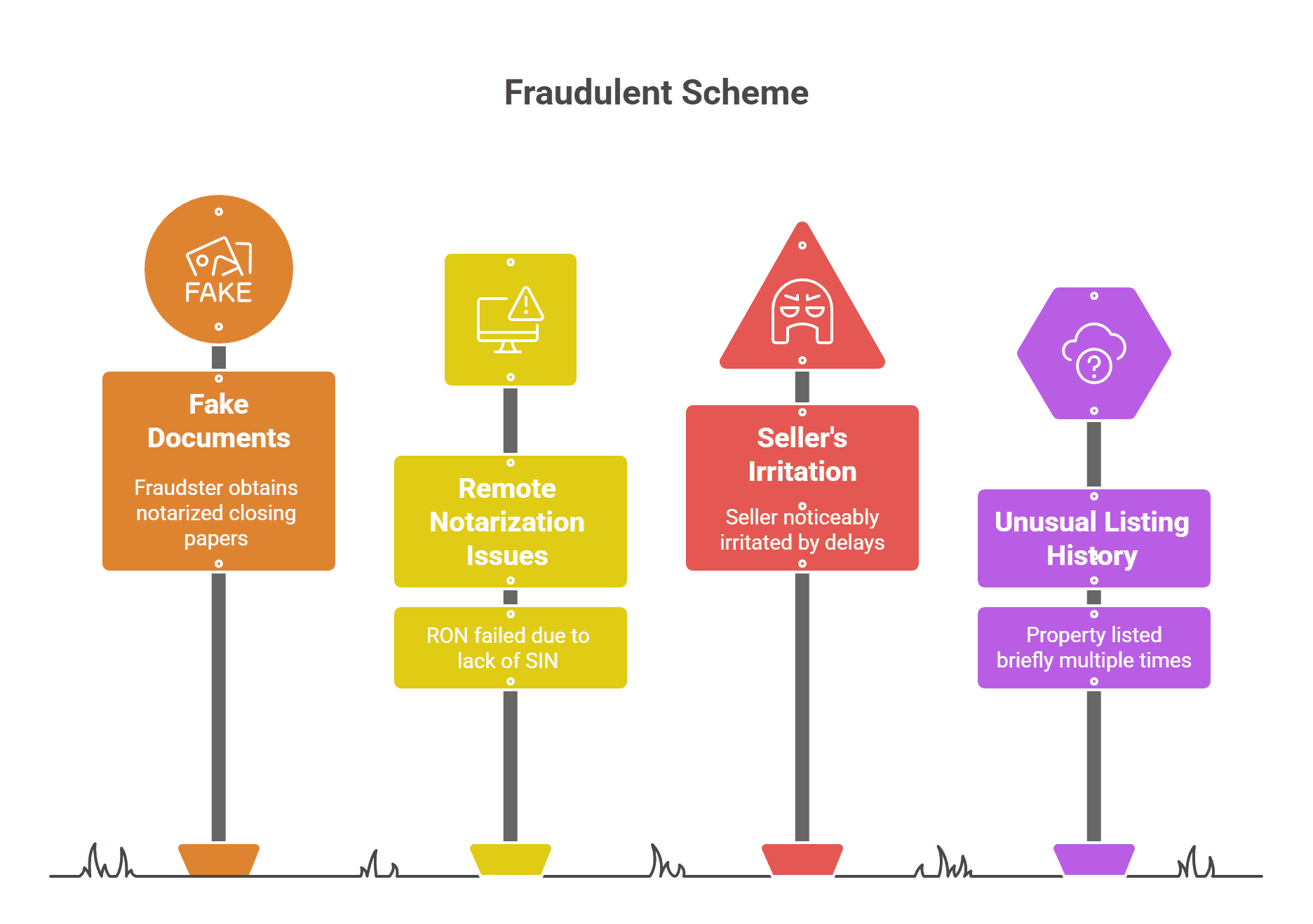

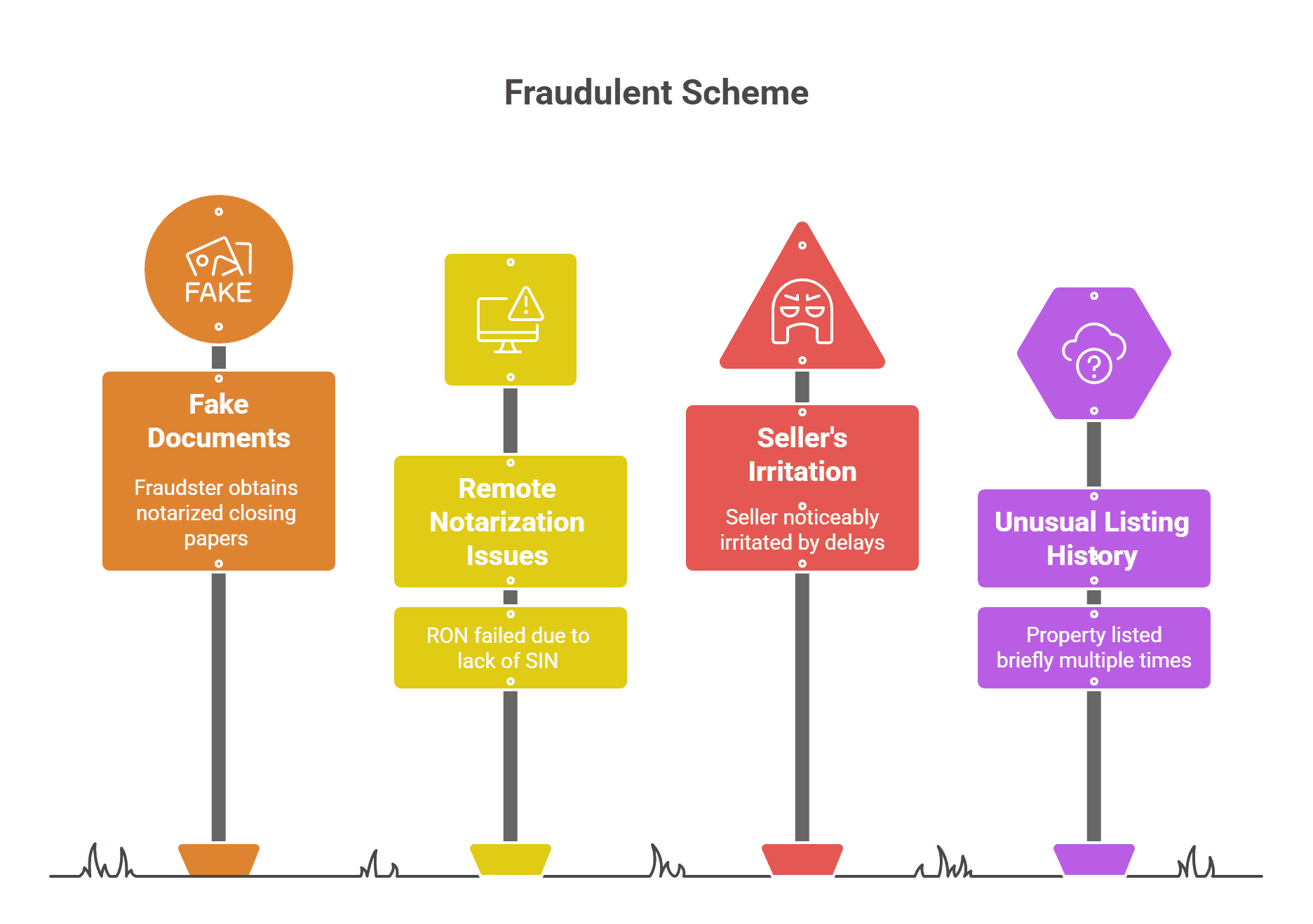

The property had been listed twice in the last 3 years (but only for a few days each time. Unusual, but we are used to sellers motivated by loose arms).

Understanding FIRPTA Tax Withholding Requirements

The price we were getting was solid, but not “too good to be true,” and there were a few hairs on the property, such as burrowing owl nests that would need to be repaired and an old seawall that would need to be replaced for about $40k. Everything aligned.

The seller appeared to work (legitimately) on oil rigs off the coast of the EU or in the Middle East. I wanted to complete the closing via Remote Online Notarization (RON), but that is only allowed within the US and Canada.

We arranged a two-day window for closing, when I would return to Canada, to manage it remotely before flying to Dubai for two months.

Closing was scheduled for Friday afternoon, but as happens (often), RON’s start time was significantly delayed to 7:30 pm ET, obviously after business hours, and without support from the title company. The salesman was noticeably irritated and I couldn’t blame him.

We followed up the next day and the RON could not be completed. His ID was verified, but since he did not have his SIN on hand (the Canadian equivalent of an SSN), the notary was unable to proceed.

This was a red flag, but not a deal breaker. The seller claims to have multiple citizenships and upon further investigation, a SIN is not issued to all Canadian citizens and is primarily for tax purposes rather than identification purposes. Also a mitigating factor was the fact that he couldn’t get any support on Friday night.

The real estate investor who brought us this deal had a scanned copy of the seller’s passport, which looked legitimate, and had put it through an anti-fraud check. In addition, the investor in this country is one of the largest in the industry, has faced scams before and has controls.

There was healthy skepticism, but things continued to work, including the seller having a legitimate canadian cell phone instead of a VOIP number typical of most scammers.

Either way, the Canadian time zone he was in had passed and we would have to work through a US embassy in Dubai to get the notarization done.

The seller confirmed an appointment at the embassy. In the meantime, we confirmed with title that we could still close without the seller having a US SIN or TIN (for FIRPTA purposes).

Again, we all considered this unusual, but if the seller was trying to avoid tax requirements, that was not our problem.

(We also had a history of closing a foreign seller FIRPTA agreement in the past with a seller who did not have a TIN, and there were no repercussions from the IRS…And mind you, that was when the government wasn’t shut down, with half the workers laid off.)

Since Florida needed two witnesses, the seller needed to bring those people to the embassy.

We were skeptical about his ability to deliver, but he kept his appointment and sent scanned copies of all the documents. Everything looked legit, the title company gave preliminary approval and we planned to finance the deal and close it 2 days later when the originals arrived via DHL.

In particular, the seller requested that the funds be distributed across three bank accounts in Dubai in installments, but again, this was plausible because we were not familiar with how each financial institution operates, particularly internationally. And we routinely see limits on domestic wire transfers, especially outbound ones.

The collapse occurred on the day of financing.

The Identical Photos No One Noticed: How AI Captured What Humans Missed

The title company wanted to confirm the electronic instructions as the last step before closing. The seller provided a US domestic account in another person’s name.

The title company pointed this out and asked the seller for an explanation. The seller said he owned a joint account with that “relative” and recommended setting up the account to be more convenient than the multiple installments of Dubai accounts.

I called the title co. VP at that time, asking that since we had come this far to verify the Dubai accounts and if they were legitimate we close them even if they charge more transfer fees to the seller for the dues.

The title company ran the review again and shortly after sent a PDF notice that said: “We cannot guarantee this transaction. We cannot provide further details.“

However, while they typically can’t share details about these decisions (liability concerns), I called them and pressed them for information, given how deep we went.

They were cautious but said the bank accounts were not verified and said: “We are very sure that this is not the real seller. Multiple flags everywhere and we can’t risk ensuring this. The seller’s package was also suspicious; Take another look at those IDs.“

I’m looking at the documents. They seem legit. I passed my threshold. He passed everyone’s threshold.

He couldn’t share more details, but: “Really pay attention to the IDs.“

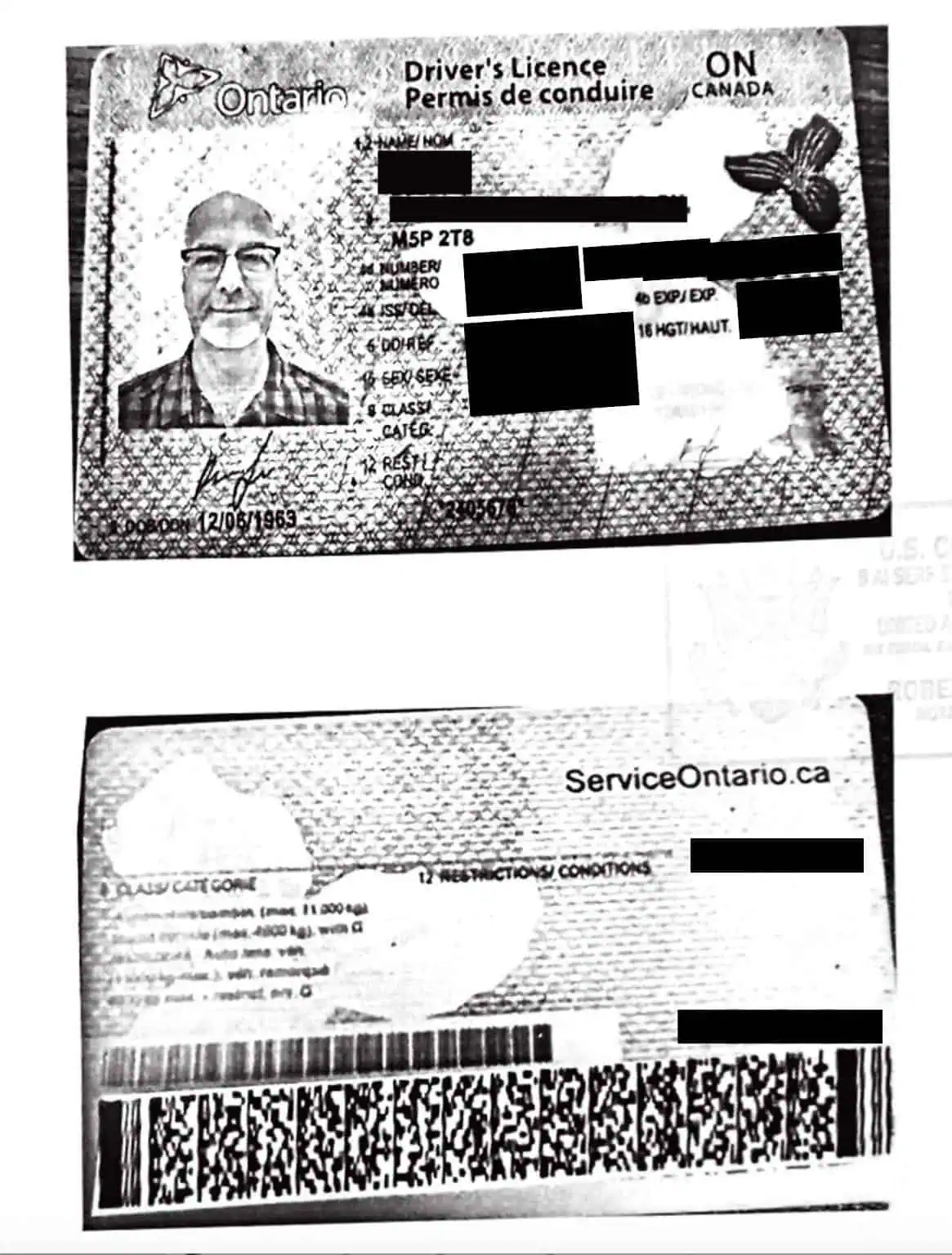

(Here’s the passport and driver’s license – names and addresses redacted. Take 30 seconds. Notice anything strange?)

So, I launched them into a sophisticated ChatGPT anti-fraud alert and the AI flagged on different topics we were all lost.

The most obvious…

Driver’s license photo and passport photo are identical.

(If you understood it right away, congratulations!)

That never happens. Ever. Different photographs, different angles, different moments. But if you’re not specifically looking for it? Your brain just doesn’t register it.

And once you see it, it’s like a slap in the face.

Other warning signs that the AI detected:

- Passport prefix discontinued before claimed date of issue

- Signature overlays removed by ~5-7 millimeters

- Multiple formatting inconsistencies are only visible with forensic-level analysis

How a scammer entered a US embassy with fake IDs and made it happen

Once the reality of this near accident began to set in, I had to sit down, Frankly, amazed at the level of sophistication of this scam.

Think about it:

It had a base of operations in Canada. It focused on a real property owner in Florida with whom he shared a similar background, and it was a near-perfect “motivated seller” scenario.

(Open question: The previous listing history of the property, was it the scammer or the real owner?)

He passed the initial identification requirements for a RON (including a passport scan), outside of the SIN… implying that he was able to answer questions such as “What color is your? [model/year] car?” either “What address did you live at?“

And the most surprising thing is that he entered a US embassy in the Middle East (?!) with a fake ID and two witnesses (were they aware of it or did they think it was legitimate?). And he successfully got his documents notarized!

Think about the courage it takes to achieve this.

If you get caught posing as someone with fraudulent documents in the Middle East, I don’t even want to think about what happens next.

Sweating bullets, holy cow…

(Makes me wonder if he went through airport security with the same fake documents.)

And he almost took $350,000.

Almost.

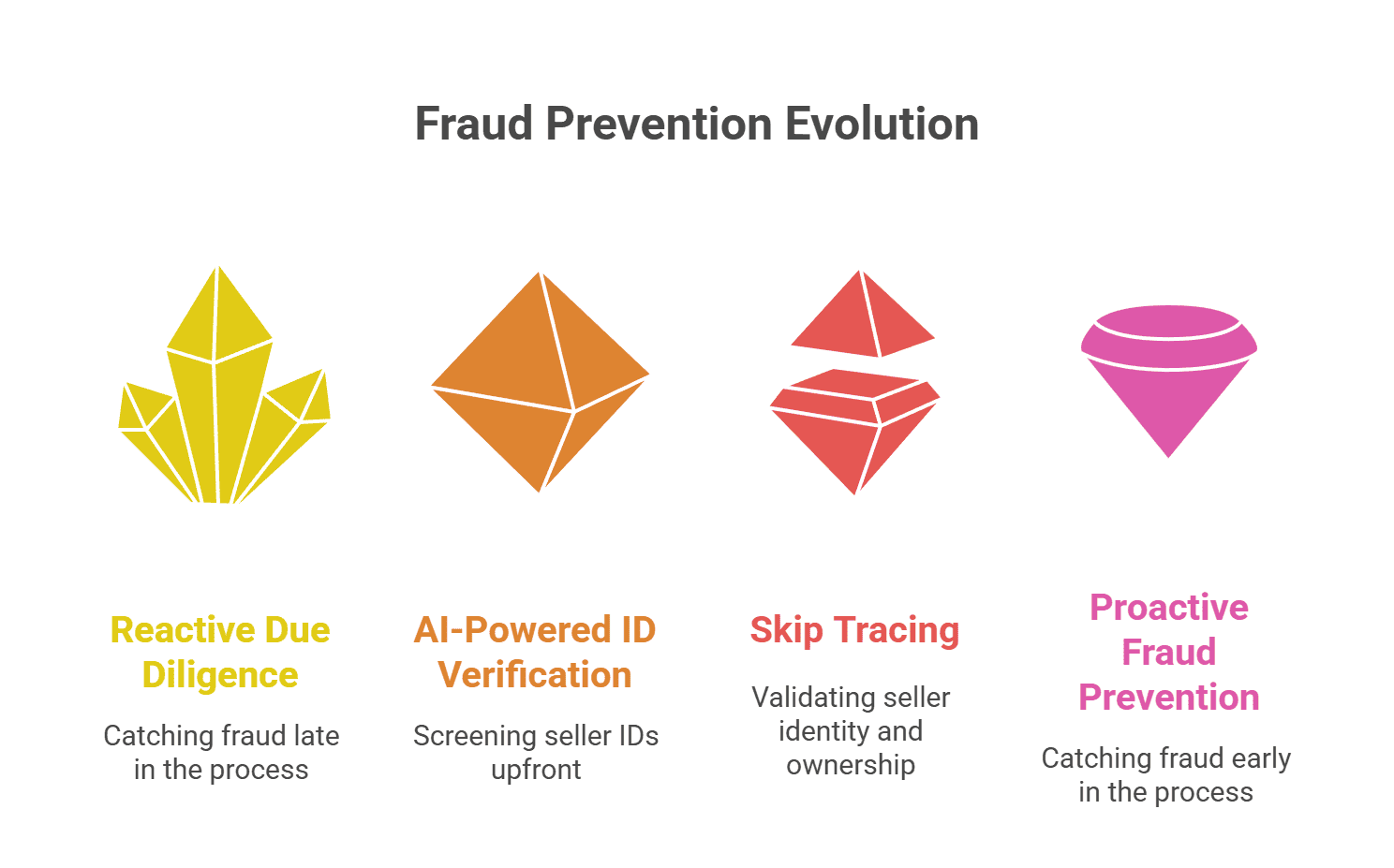

Fraud Prevention Protocol: AI-based identity verification before due diligence

We now request seller IDs upfront and review them sophisticated AI anti-fraud indications before investing any DD resources.

Here is the custom GPT we created: [Access the Fraud Detection GPT here]

Will that capture everything? No. But I would have caught this guy immediately.

Note: Florida is the highest fraud state in the country and international sellers require additional scrutiny. But even with national agreements, run identifications through AI before digging deeper.

(After recently discovering another fraudulent sales attempt, we will also avoid tracking each seller, in addition to reviewing their IDs, so that we can detect if there are red flags associated with their communication methods. The risk of fraud is higher for cold calling, text message or PPC leads.)

The title company ultimately saved us because they are the one facing the most liability. What if they had insured this and the true owner filed a title claim? We would have to return any profits from the sale of the property. They would have to undo the entire chain of title and refund our down payment to purchase the property.

It’s an absolute nightmare scenario that could haunt us even years later.

Thanks to them for catching it when we were all ready to close.

Reality check: We dodged a bullet and learned a valuable lesson.

Next time? We will detect it at the identity verification stage…not on the day of funding.

=====

Are you looking for funding from operators who learn from situations on the brink of disaster? Serious Land Capital now runs AI fraud detection on every seller ID before investing significant DD resources. Minimum purchase price of $50K. Very liquid and ready to move at any time.

Analyze your property today

Originally published in https://seriousland.capital/newsletter/ October 20, 2025