UBS released their 2025 Family Office Report. Nothing groundbreaking but interesting to see what Family Offices around the world are thinking about.

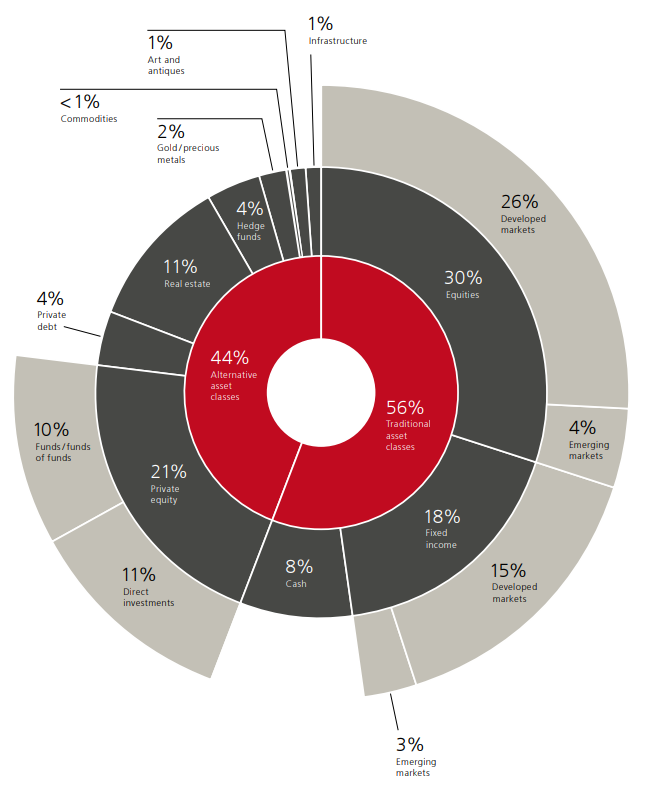

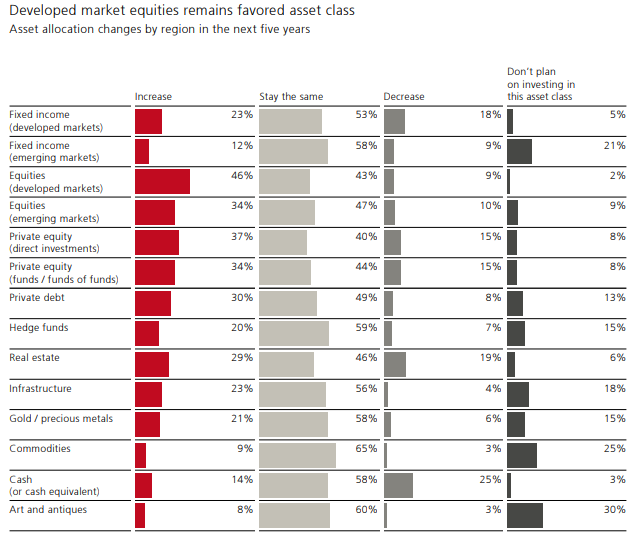

Below is the average asset allocation of the Family Offices surveyed, this is what I notice:

-

44% in alts

-

51% between private and public equity

-

No commodity exposure

-

Yet to embrace infrastructure or private credit really

-

26% of portfolios in cash and fixed income

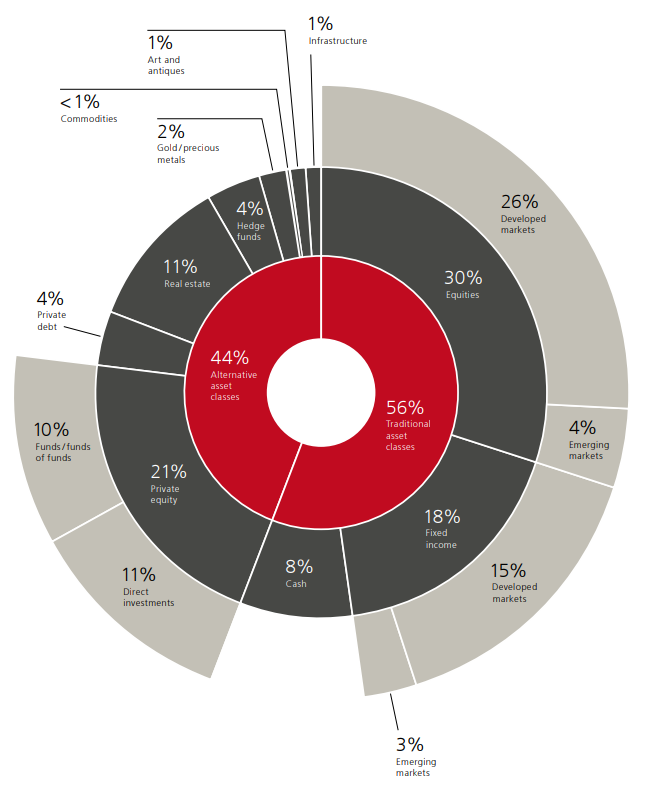

How have the allocations changed over time? Larger allocations to fixed income as yields rose and larger allocations to public equities over privates.

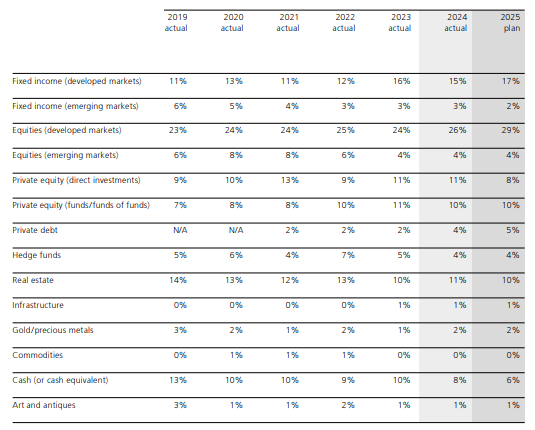

Family Offices favour deployment into public equities and hope to put cash to work in the next 5 years. Despite strong gold performance and low starting weight, limited consensus to increase exposure.

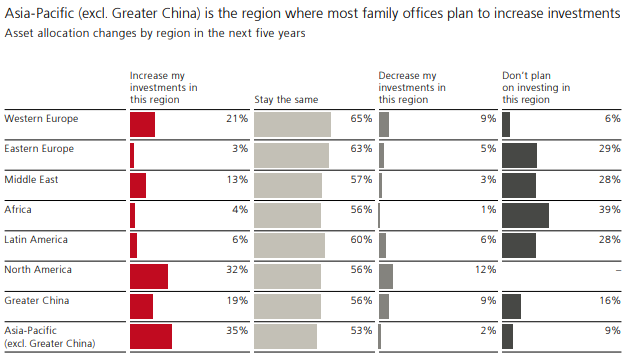

North America and Asia-Pacific are regions where Family Offices want to invest more.

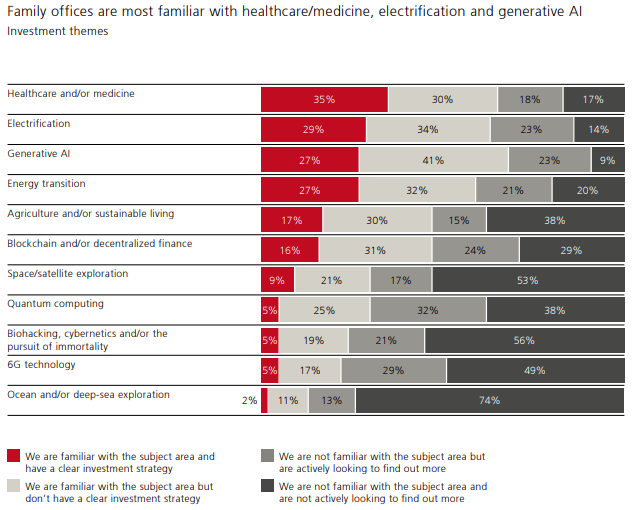

The top themes Family Offices are investing in are healthcare, electrification, AI and energy transition.

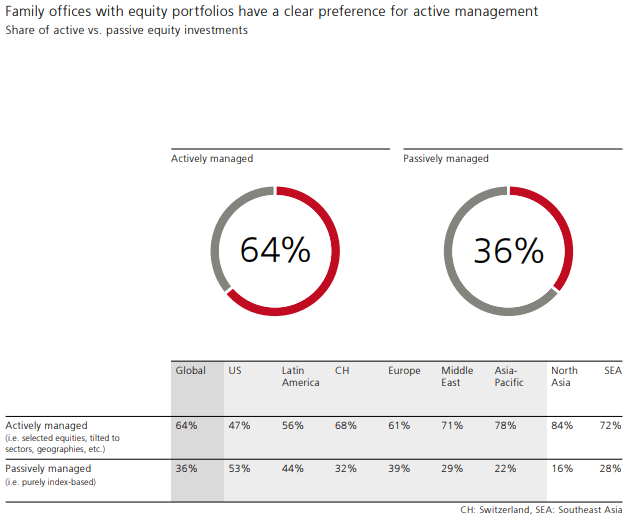

Family Offices prefer active management. Americans are more likely to invest in equities passively, likely due to the performance of passive indices over the past decade.

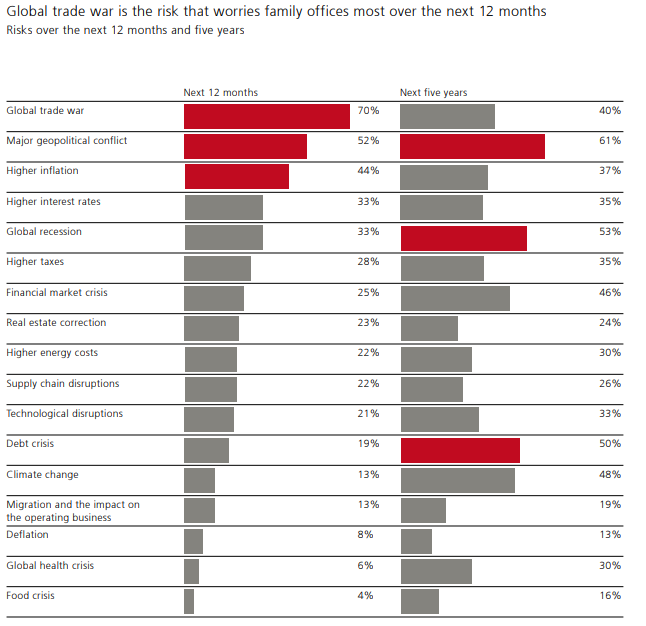

Geopolitics inclusive of trade wars is seen as the biggest risk in the next 12 months and over the next 5 years.

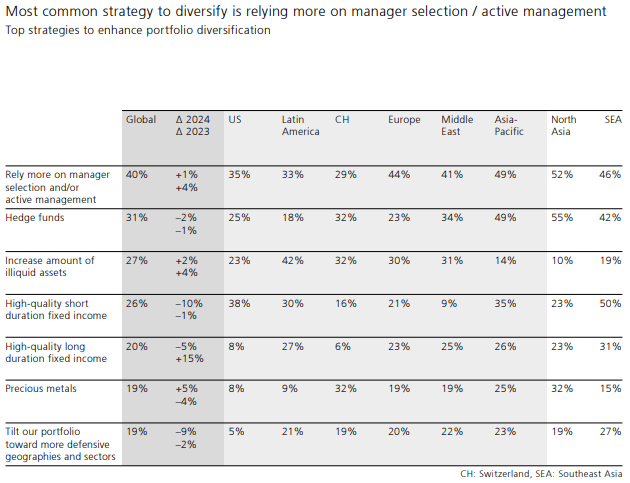

Family Offices tend to rely on active management to diversify their portfolios with hedge funds second.

Strategic asset allocation, financial reporting and risk management are the most common functions that Family Offices have in-house.

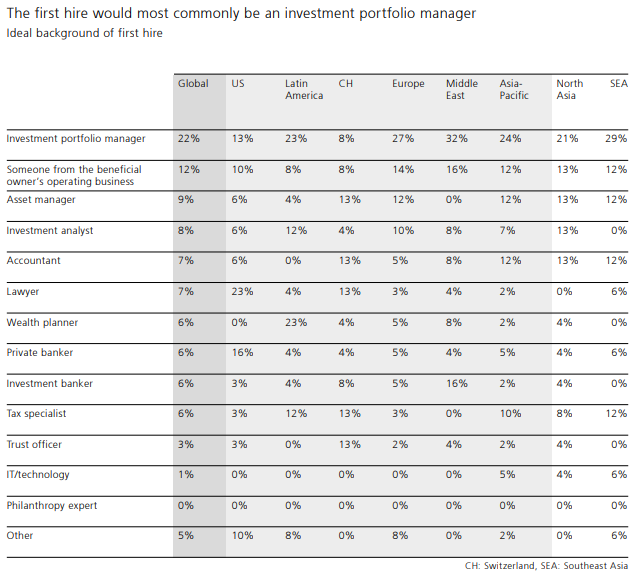

A portfolio manager tends to be the first hire Family Offices make.

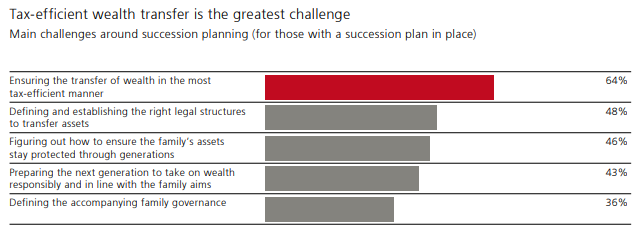

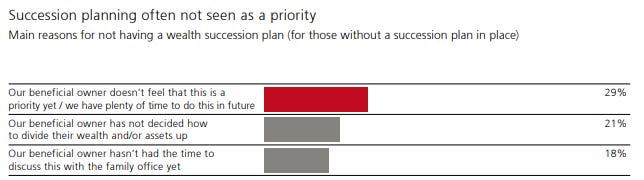

Tax planning the transition of assets is the biggest challenge Family Offices see, that’s if the Family even has a succession plan.

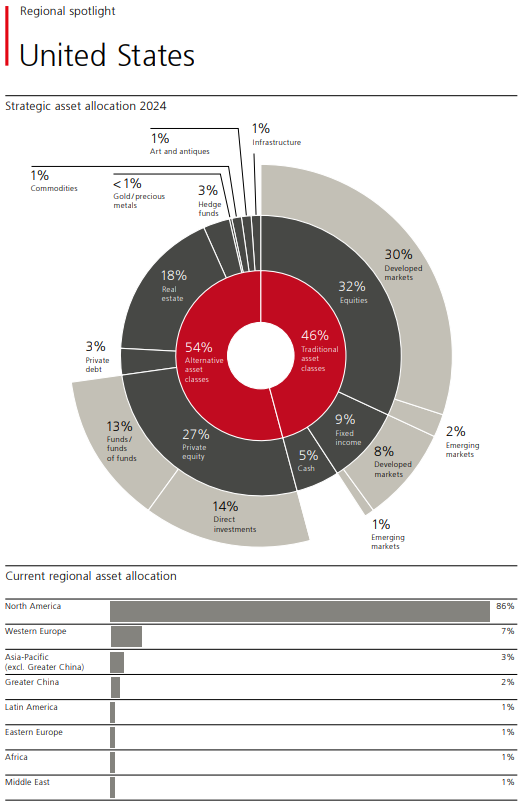

Some interesting divergences globally. Lots of home bias is exhibited.