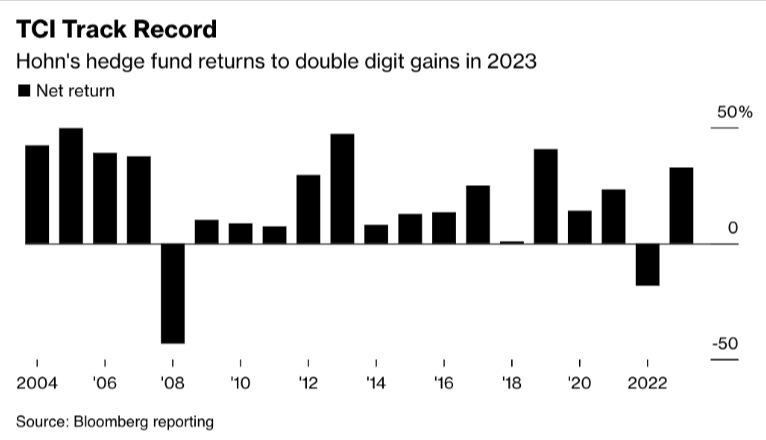

Weekend listening. Sir Chris Hohn, founder of The Children’s Investment Fund (TCI) in 2003, is one of the world’s most successful investor. TCI has grown to over $63 billion and achieved annual returns of ~18%, gaining in 18 of its 20 years.

Another good one. Russell Napier talks about global imbalances. Mostly speaks about decoupling from China and financial repression. His current portfolio views are:

-

Don’t own bonds

-

Think about jurisdiction risk

-

Winners of past 30 years are unlikely to be winners of the next 30 years

-

Value over momentum

-

Bullish on the UK

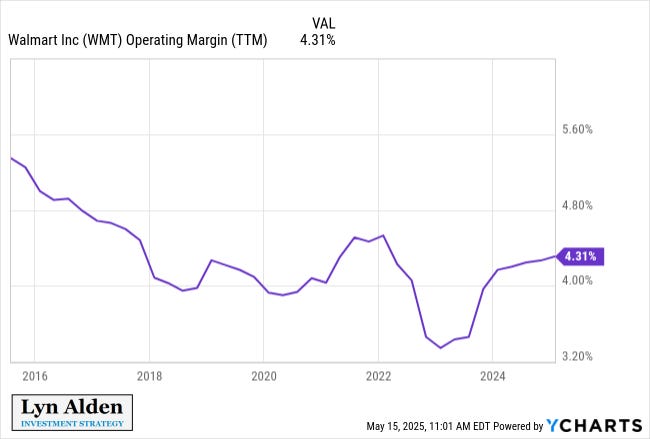

Walmart plans to raise prices due to tariffs impacting merchandise costs. CFO John David Rainey stated the rapid price increases are historically unprecedented. With narrow 4% operating margins, Walmart has no choice but to pass costs onto consumers. (@LynAldenContact)

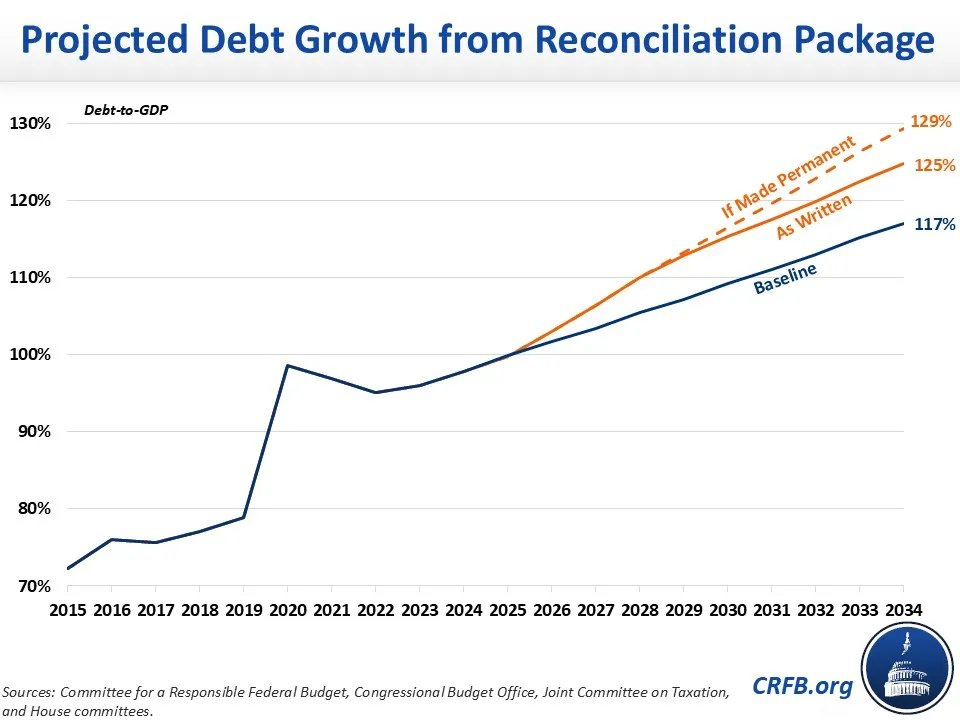

Trump’s tax bill is expected to add a few trillion to deficits.

The developing House reconciliation bill is shaping up to add roughly $3.3 trillion to the debt through Fiscal Year (FY) 2034 and is setting the stage for more than $5.2 trillion of additional debt if policymakers ultimately extend temporary provisions.(CRFB.org)

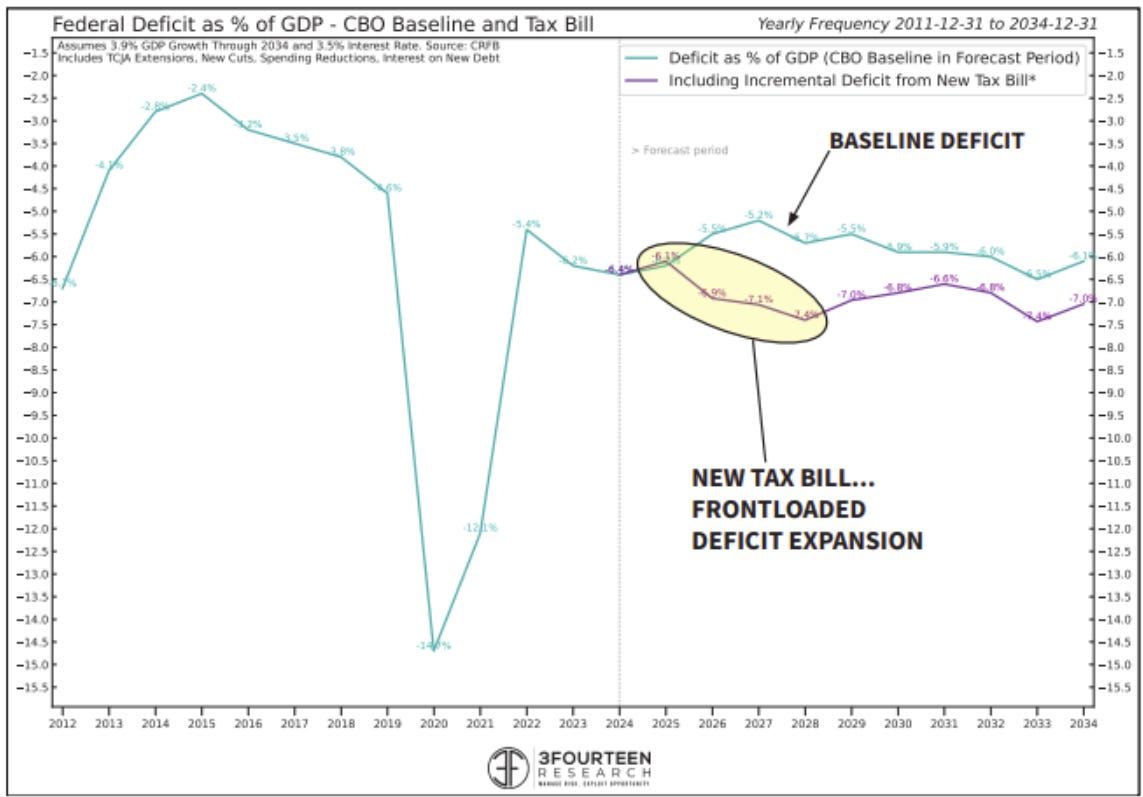

As a % of annual GDP, 7% deficits now the norm. There will likely be concessions prior to this getting passed. @3F_Research

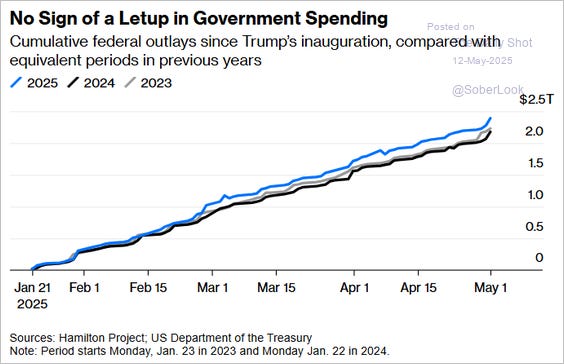

Latest update, DOGE didn’t work. Government outlays are up over previous years. (The Daily Shot)

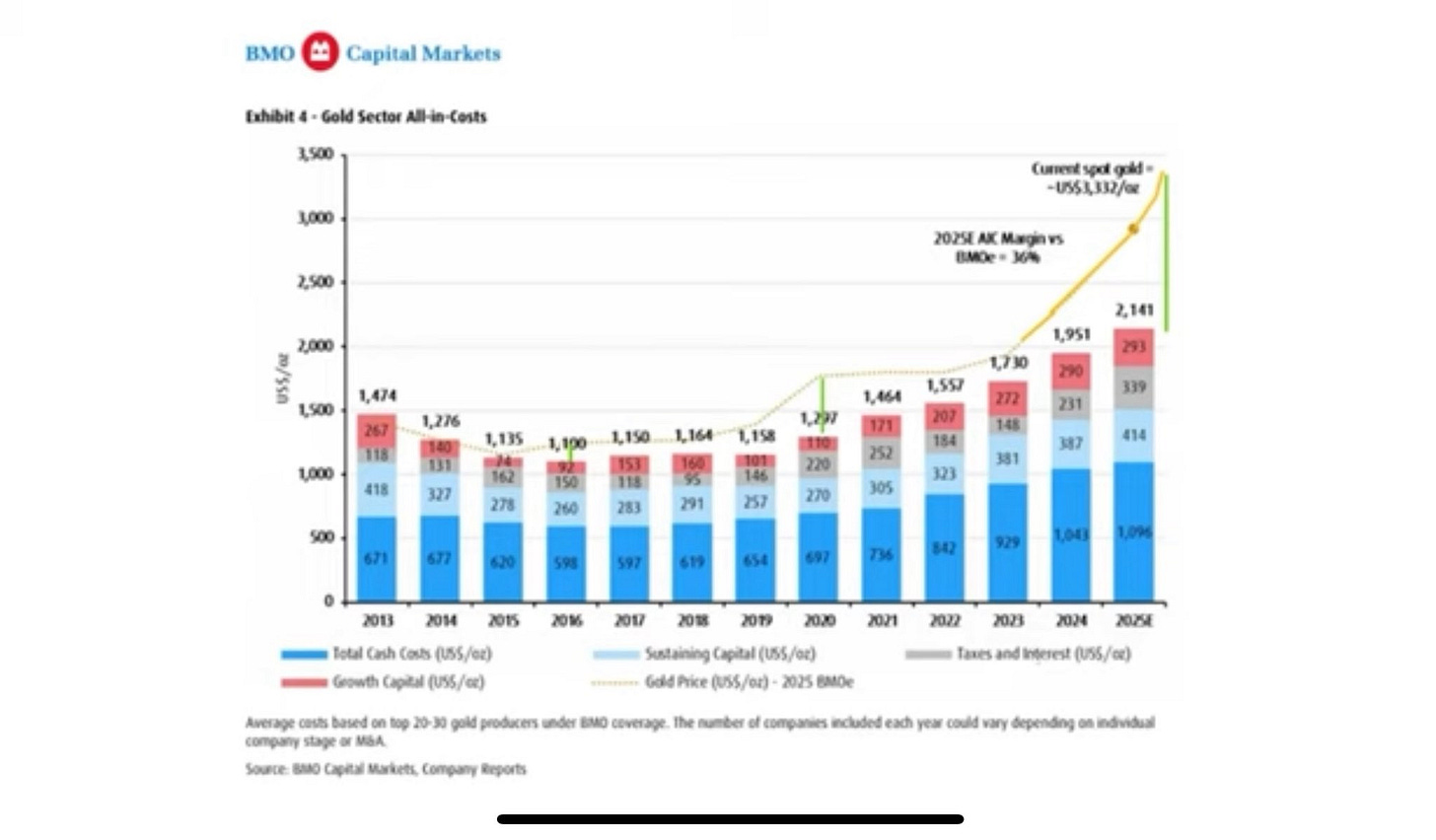

Gold miners haven’t rerated to reflect the recent rise in gold prices. Gold miners could deliver record profits in 2025. Either gold miners are cheap or the price of gold is going to fall. The lack of fiscal discipline in the US is an argument for the former. (@BurggrabenH)

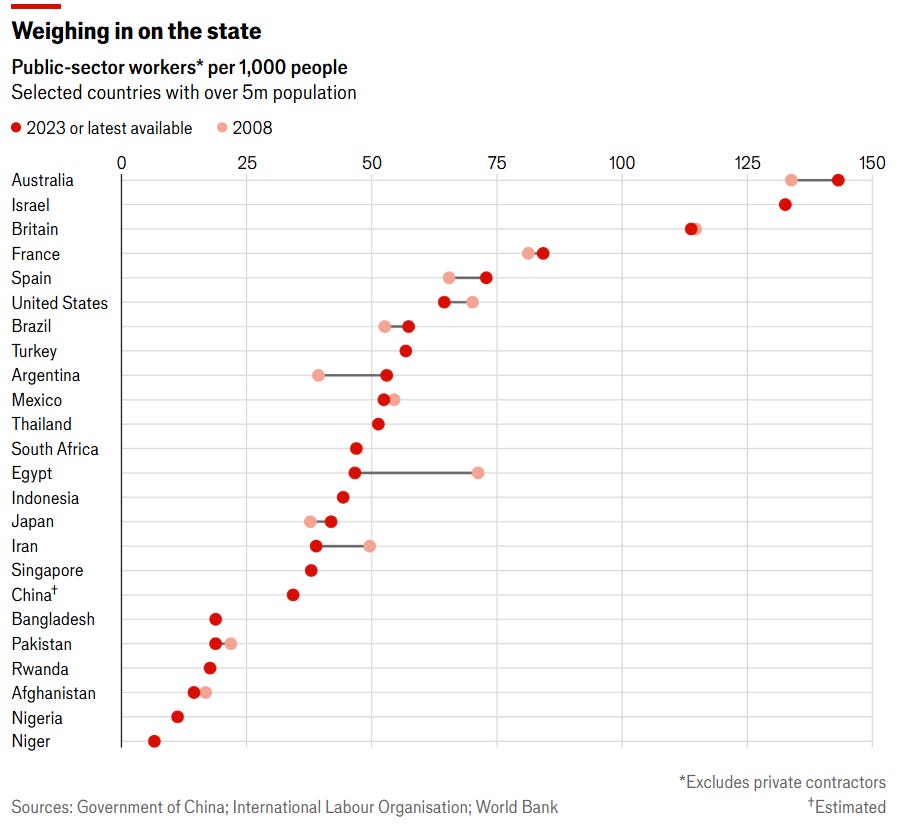

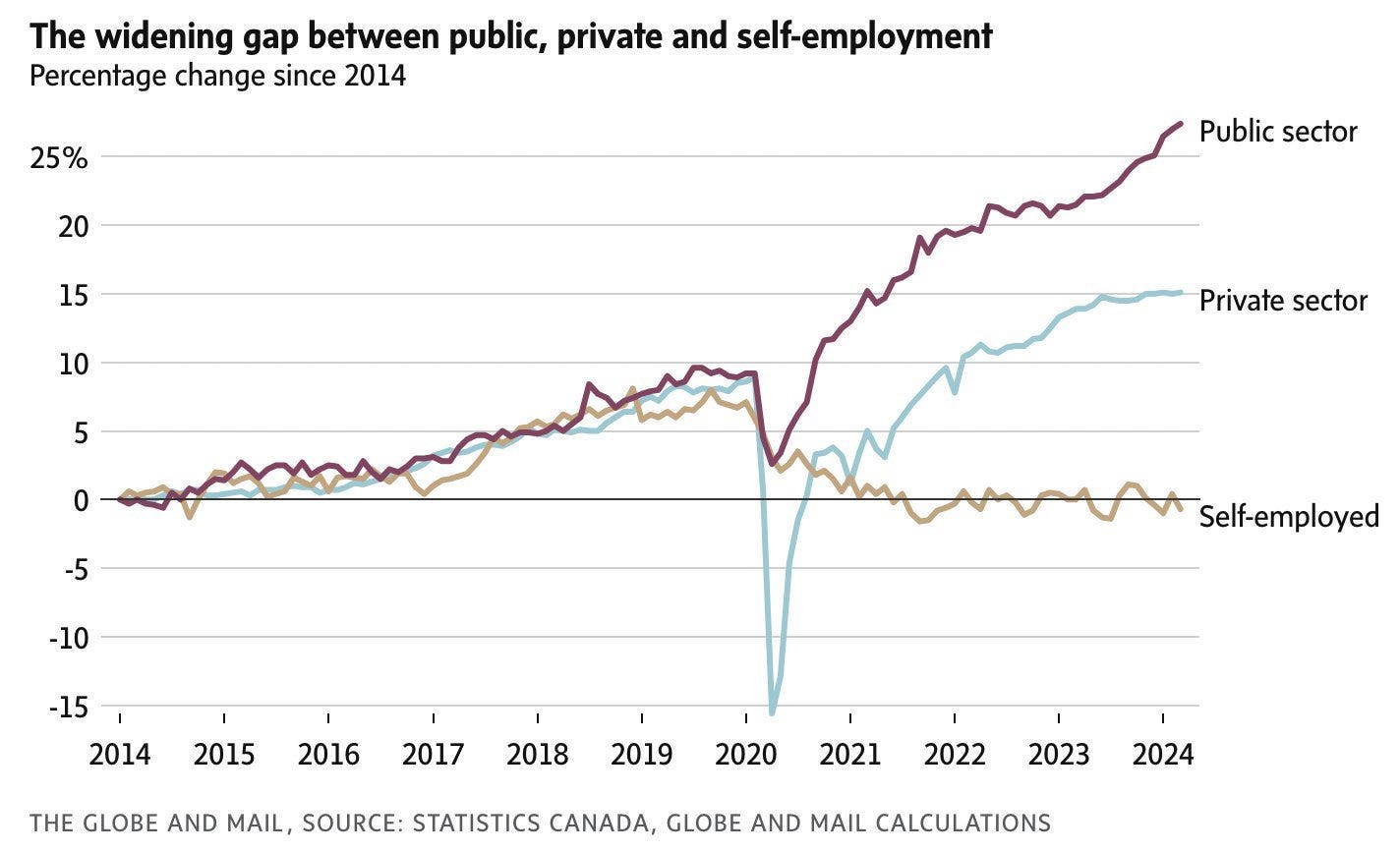

Developed nations typically have larger public sectors. However, accurately measuring and comparing government workforce sizes is challenging due to varying bureaucratic structures. (The Economist)

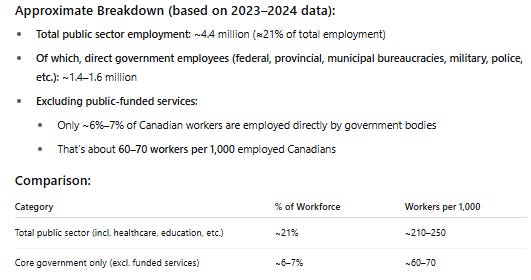

Approximately 21% of Canadians have jobs tied to the Government.

The concerning trend is that the public sector continues to grow as private sector employment plateaus. (@MPelletierCIO)

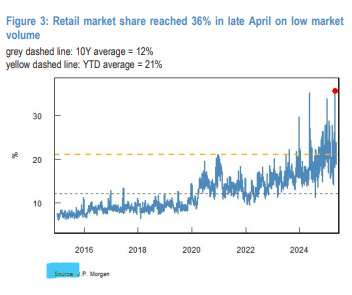

Retail trading market share peaked at a record 36% on April 28-29, significantly exceeding the year-to-date average of 21% and the long-term average of 12%. (@neilksethi)

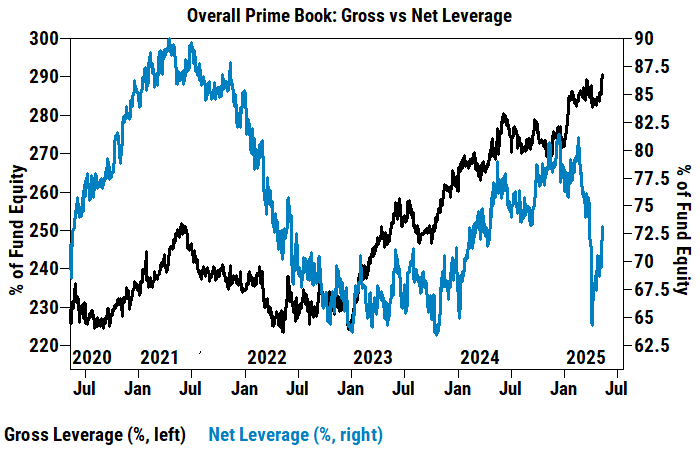

Hedge fund net exposure remains cautious, with significant short covering, though further upside potential exists if the market rally continues and hedge funds are forced to chase. (@dailychartbook)

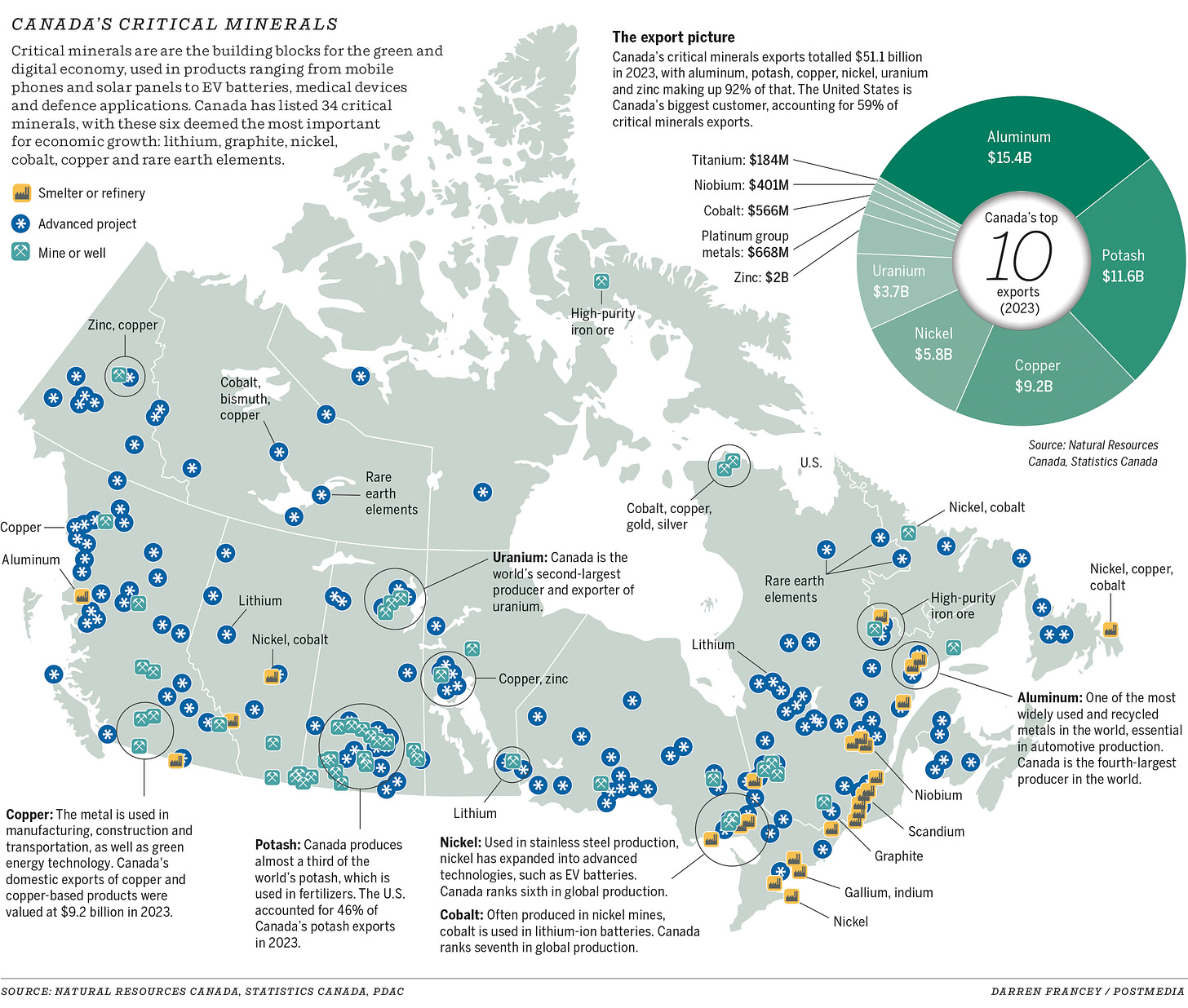

Canada can be a critical mineral powerhouse. (Natural Resources Canada)