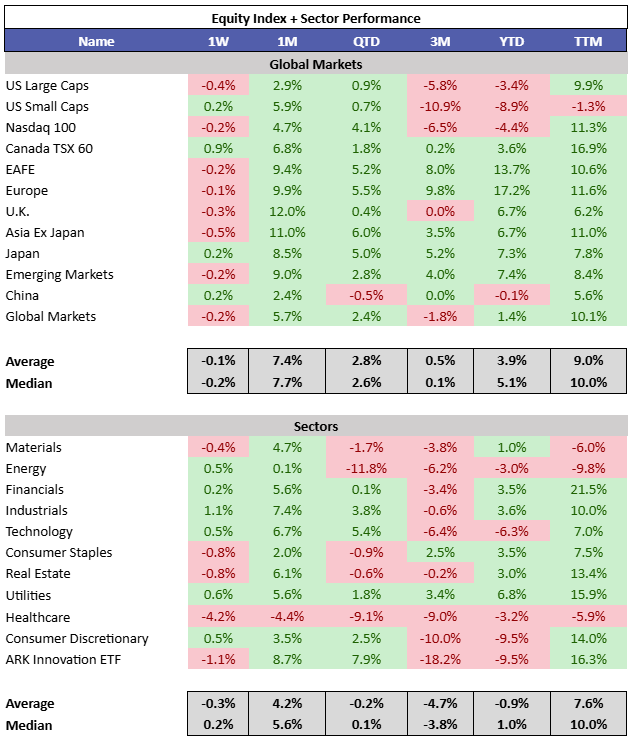

Relatively quiet week for equity markets as they treaded water globally. Alleged progress on US-China trade talks over the weekend, details are expected later today. The administration now appears to be supportive of markets rather than having the intent to blow up the global trade system, supporting risk-on behavior. US-UK announced a trade deal that appeared to be a nothing burger. Conflict erupted between Pakistan and India but markets didn’t seem to care. Industrials were the top performing sector and Healthcare was the worst on tariff fears.

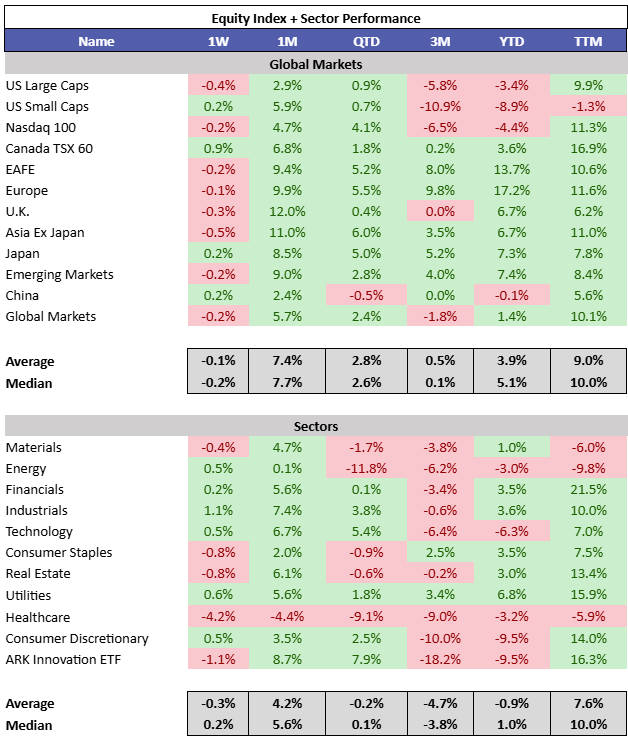

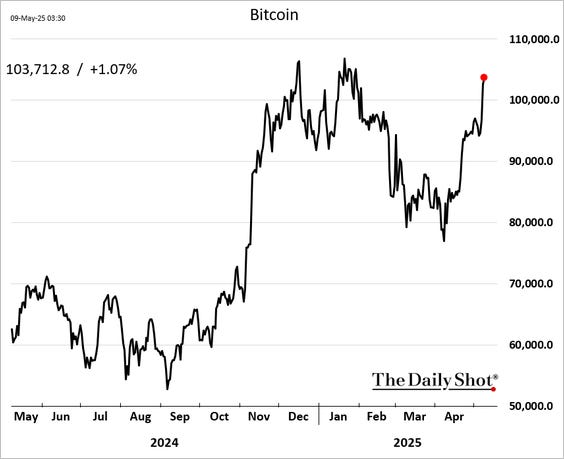

10Y yields were up 7 bps in the US and down 2 bps in Canada. Energy drove commodities higher. Gold recovered losses from the previous 2 weeks. Bitcoin posted a strong week, closing the gap on gold YTD. Ethereum surged after headlines around corporate technology adoption, still down 30% YTD.

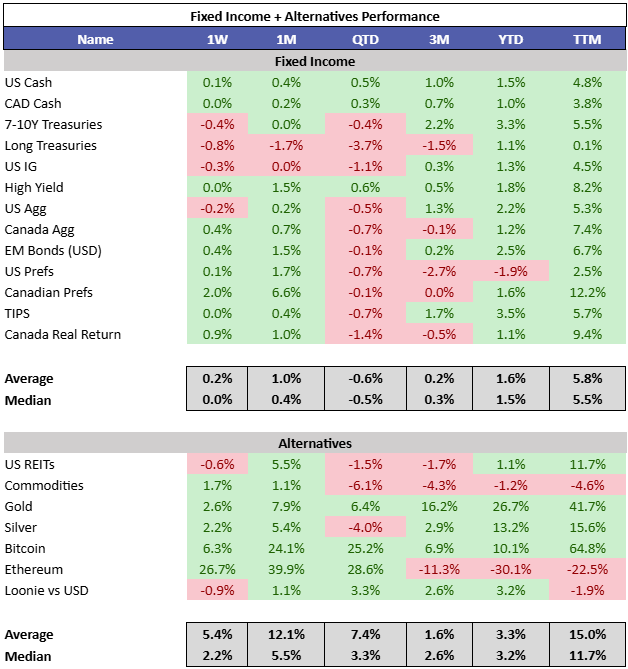

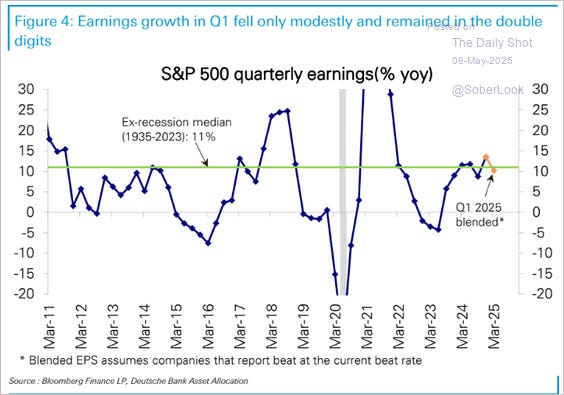

Earnings per share grew 12% YoY in Q1 compared to an expected 6%. (@MikeZaccardi)

Looking back 15 years and even back to 1935, earnings growth looks healthy. (The Daily Shot)

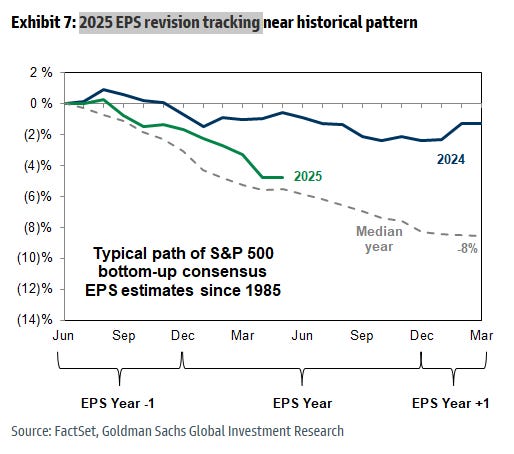

Wall Street’s dirty trick is revising down earnings so companies beat. Revisions have not been abnormal. 2025 earnings per share revisions are tracking slightly above the median year since 1985. (@MikeZaccardi)

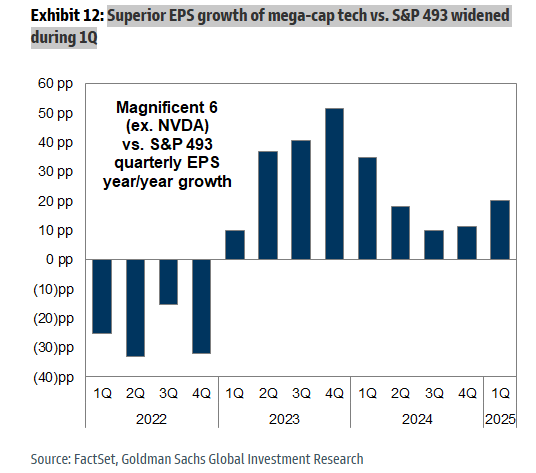

Tech continues to do the heavy lifting for S&P 500 earnings. (The Daily Shot)

The Magnificent 6 (ex Nvidia, would skew the data positively) remain magnificent. The Mag 6 have delivered significantly stronger earnings growth relative to the S&P 500 since the end of 2022. @MikeZaccardi

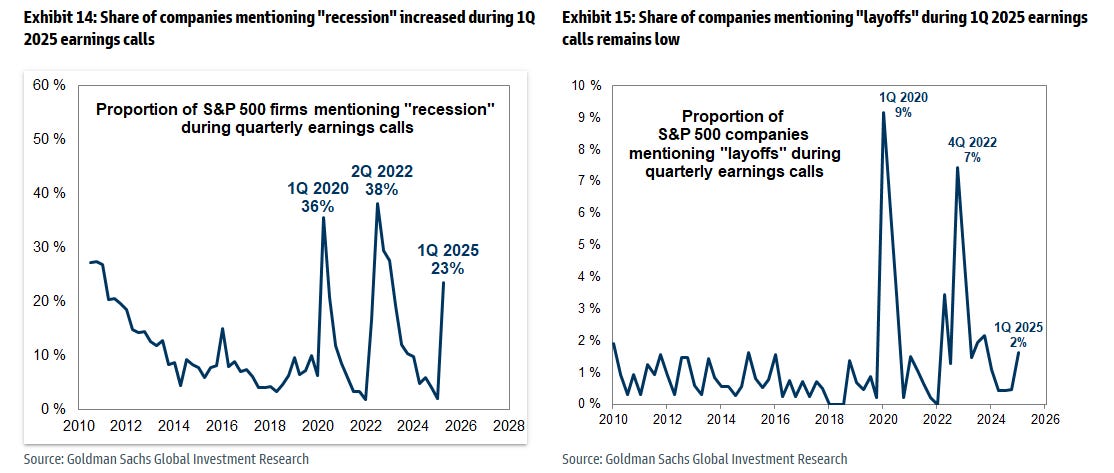

During Q1 earnings calls, “recession” was cited by 23% of companies, compared to only 2% mentioning “layoffs.” Recessions typically see earnings decline before layoffs, but current earnings don’t warrant panic. (@MikeZaccardi)

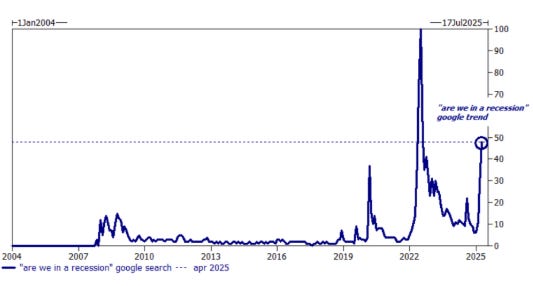

Earnings data is strong but current sentiment remains a concern. “Are we in a recession” Google searches are near record highs, exceeding levels seen during actual recessions. @neilksethi

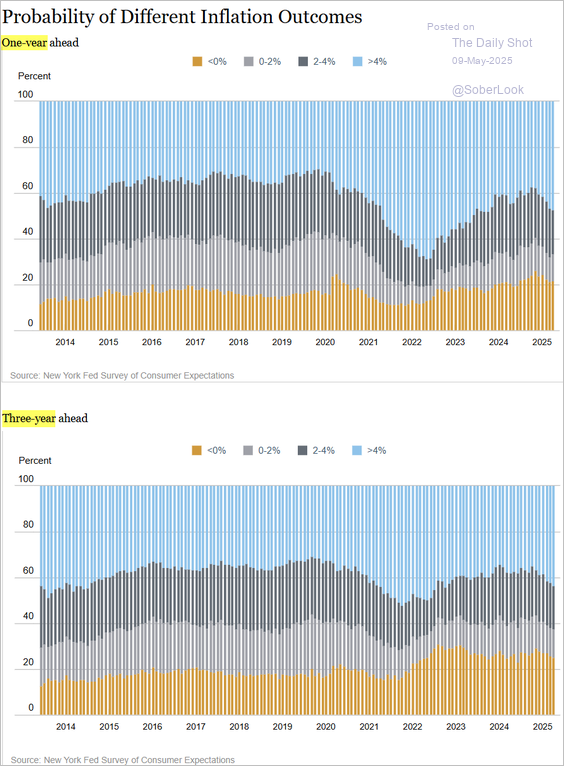

The New York Fed’s Survey of Consumer Expectations indicates that half of respondents anticipate inflation exceeding 4% over the next three years, reflecting ongoing inflation concerns. (The Daily Shot)

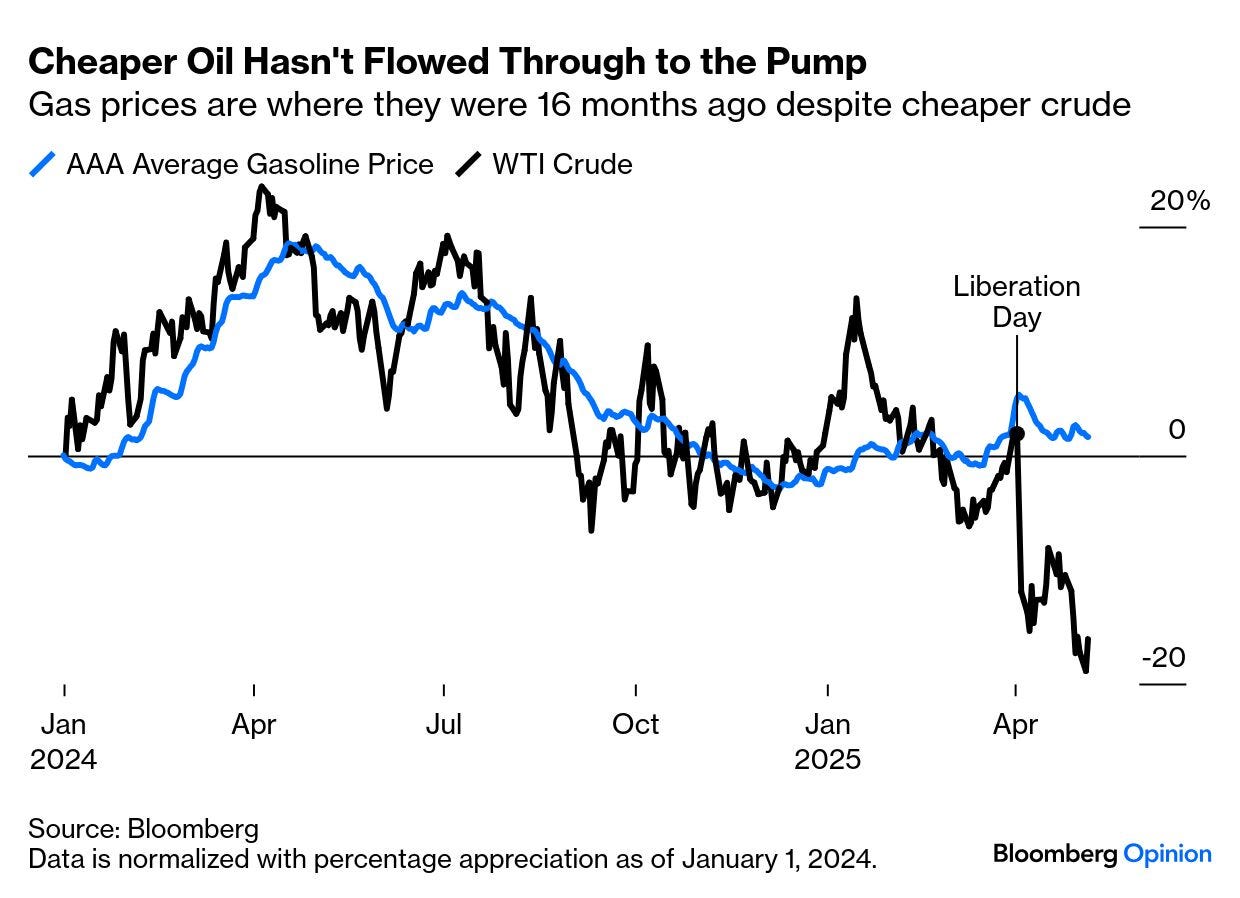

Cheaper crude prices have yet to flow through to households. (John Authers)

Bitcoin has recouped all its losses on the year, back above $100k for the first time since January. The sentiment within the crypto community over the weekend can only be described as euphoric. (The Daily Shot)

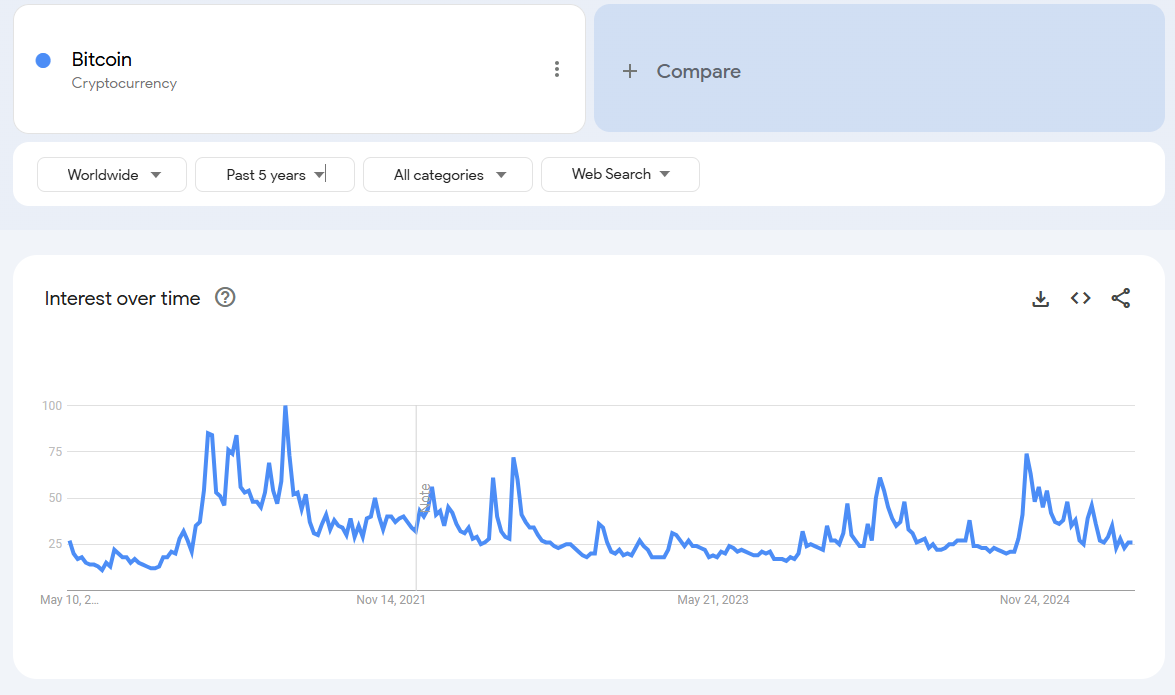

However, as Bitcoin approaches all time highs, the general public is largely uninterested. Bitcoin google search activity is close to 2022 levels when it was trading just above $20k.