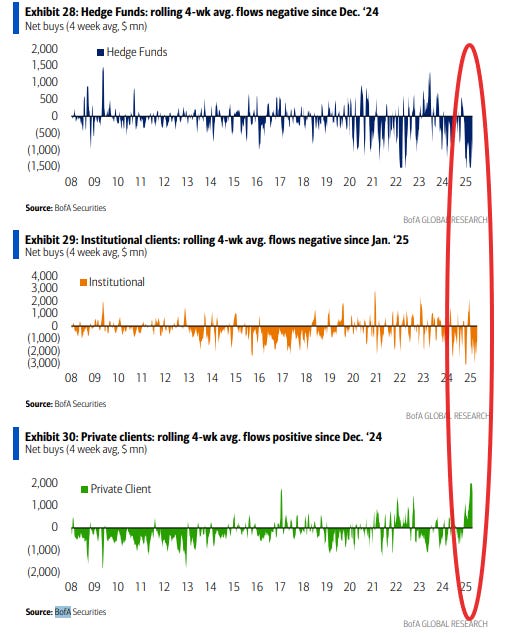

Better illustration highlighting retail’s recent dip buying activity while hedge funds and institutions were sellers. (@neilksethi)

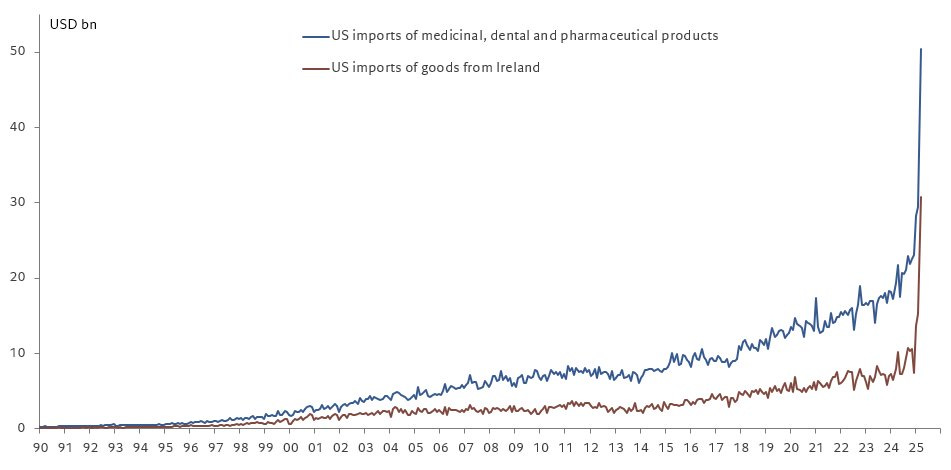

The healthcare industry was one of the major culprits of tariff front running. (@fwred)

We haven’t seen a spike in inventories from retailers that we would have expected based on all the frontrunning headlines. (The Daily Shot)

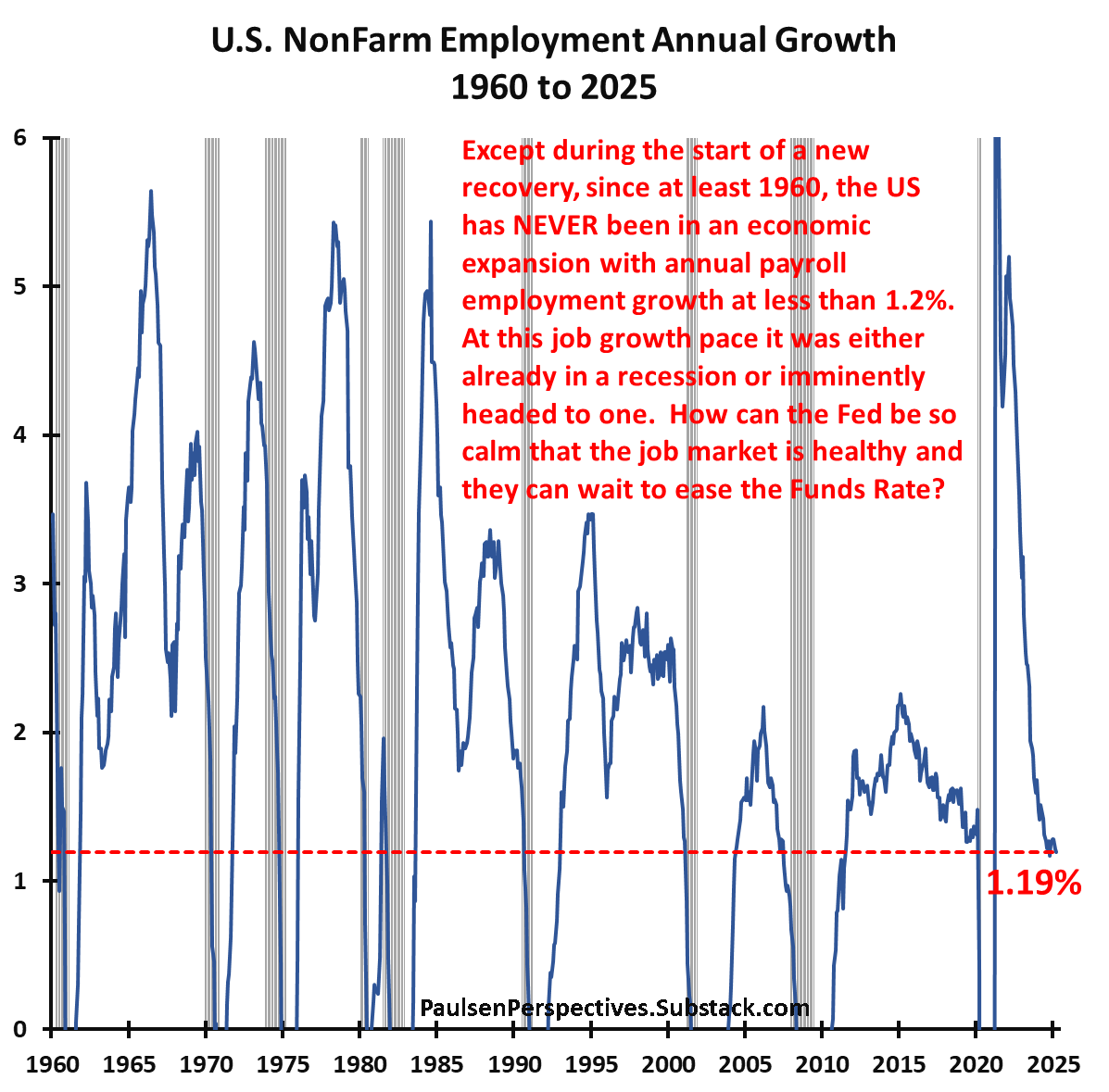

Employment growth does not paint a picture of US economic strength. (@jimwpaulsen)

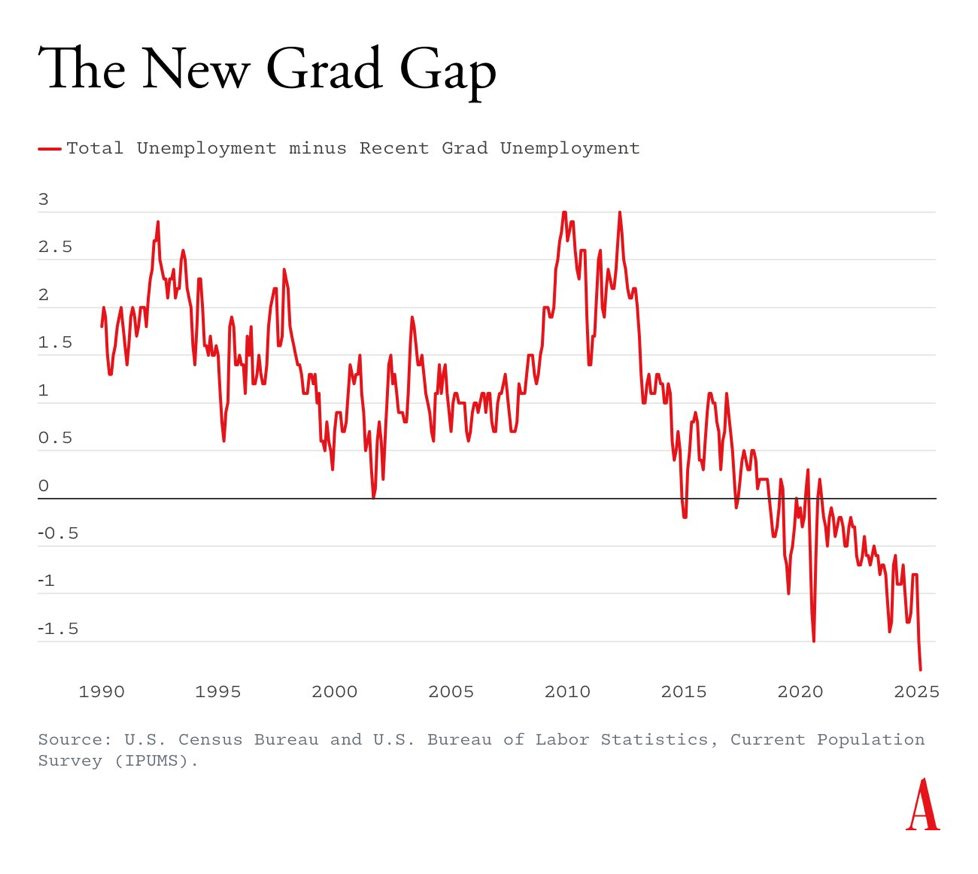

Additionally, recent college graduate unemployment now exceeds overall unemployment for the first time. (@BoringBiz_)

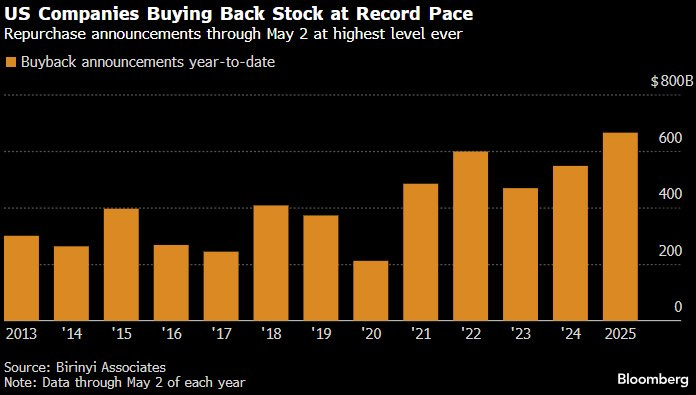

US stock buybacks announced YTD exceed $600B, pace exceeds 2022’s high of $598.5B. This could help buoy equity markets. (@LizAnnSonders)

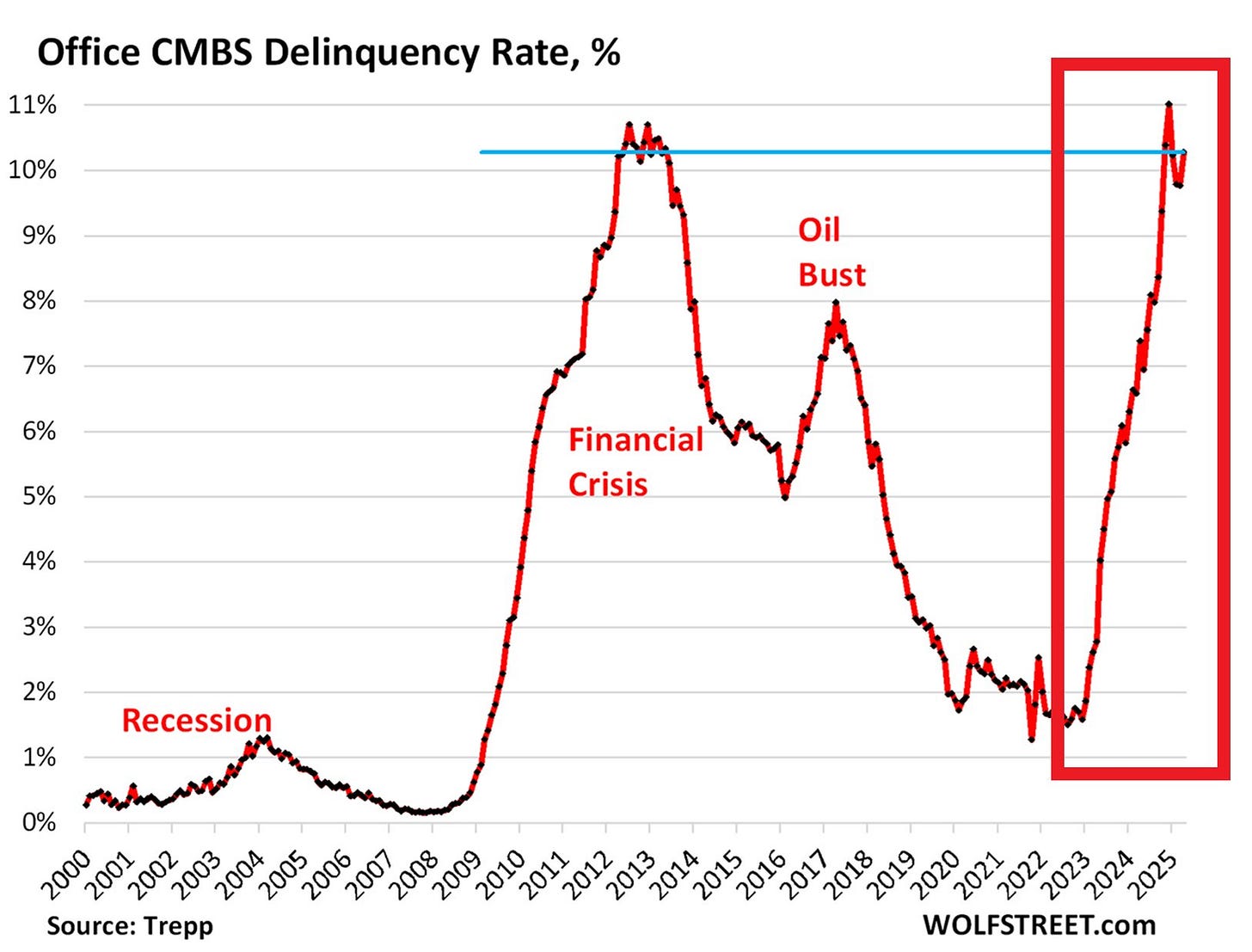

Office debt delinquencies remain at global financial crisis levels being hit by the double whammy of weak employment growth and higher rates. (@GlobalMktObserv)

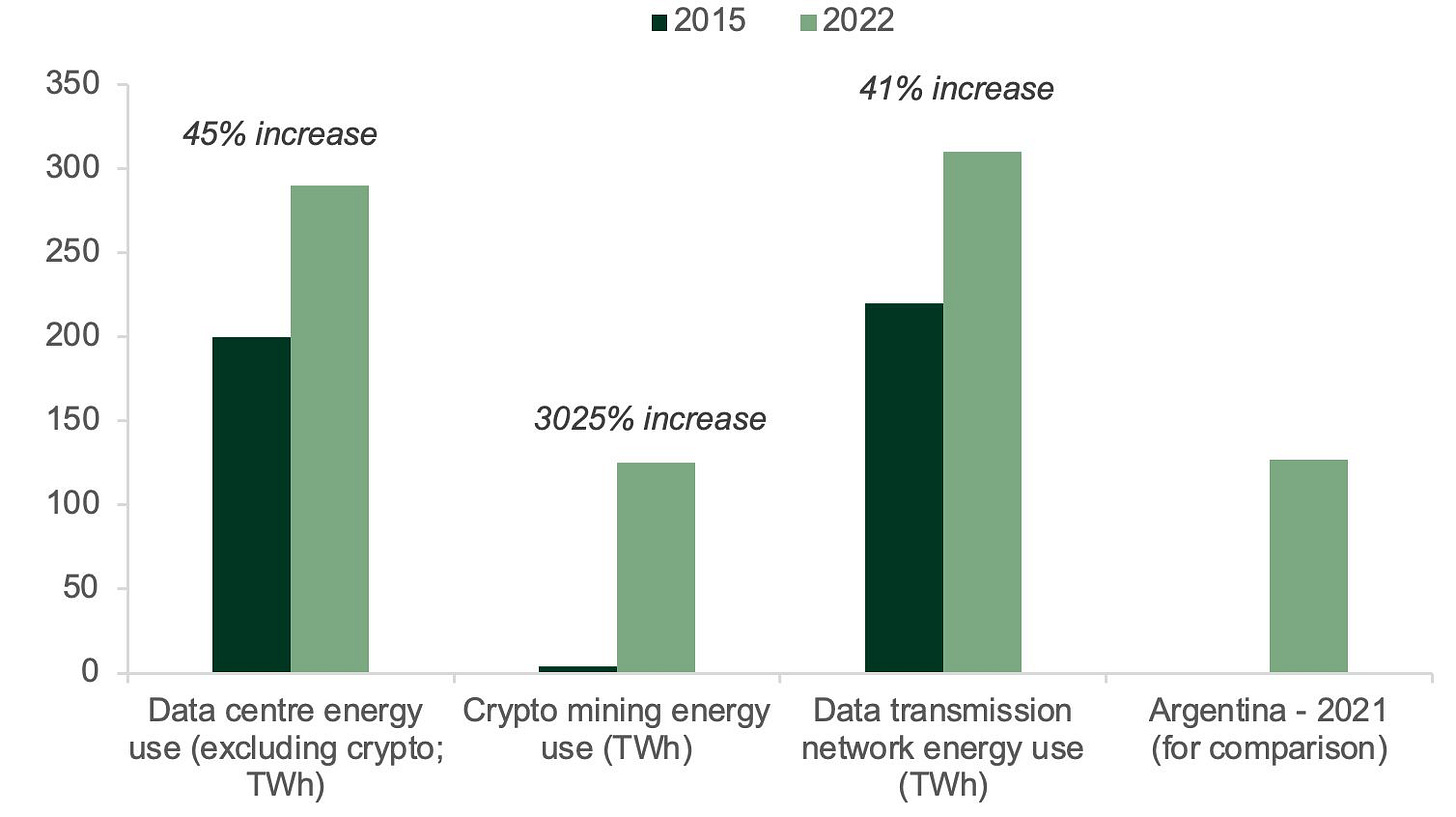

The data economy has seen explosive electricity usage growth since 2015. These uses consume more electricity than some entire countries. ()

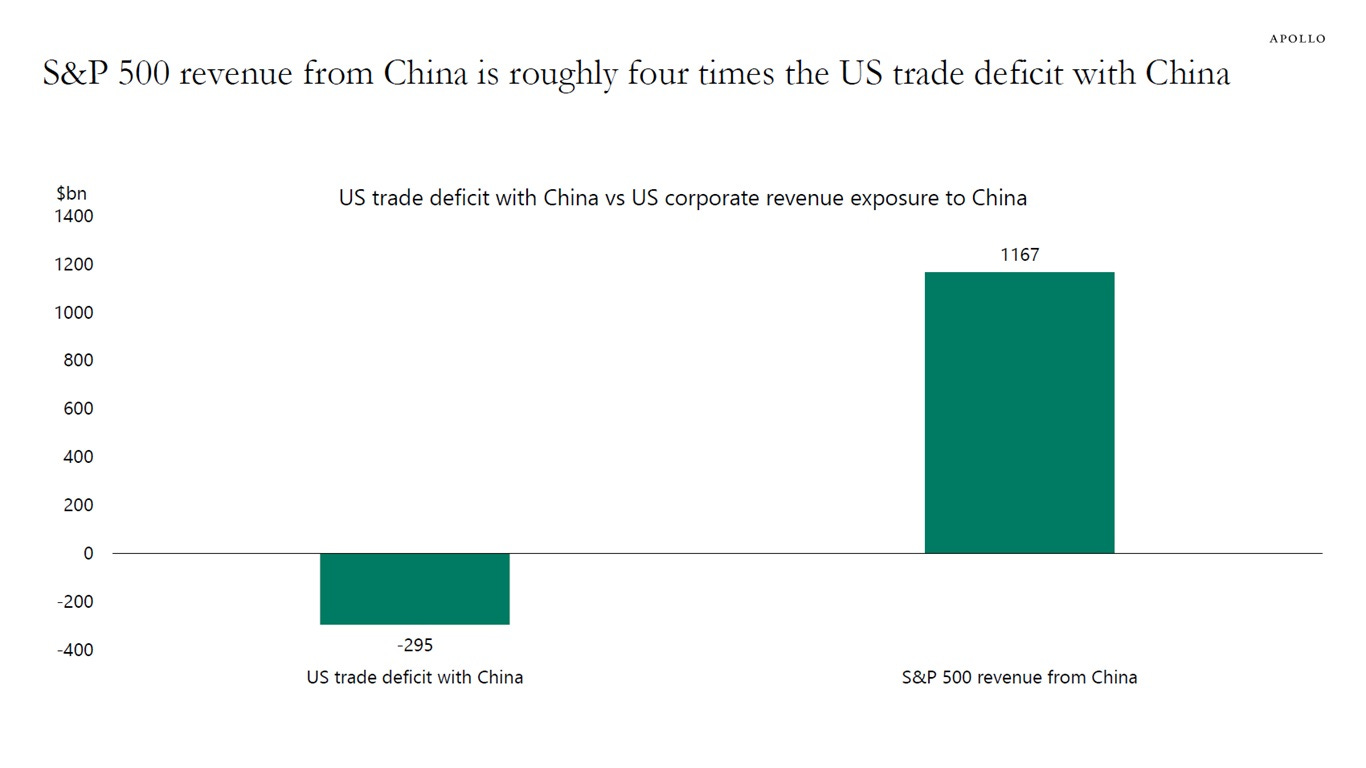

S&P 500 companies generate approximately 7% of their annual revenue in China, totaling $1.2 trillion. This revenue from Chinese consumers is roughly four times the size of the US-China trade deficit in goods. Comments from Scott Bessent indicate the US may become more targeted around strategic industries. (Apollo)

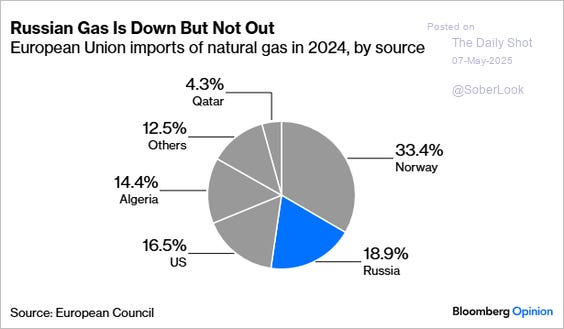

The EU is still heavily reliant on Russian gas. (The Daily Shot)

Clear signs that China is routing global trade through other Asian countries. (@robin_j_brooks)

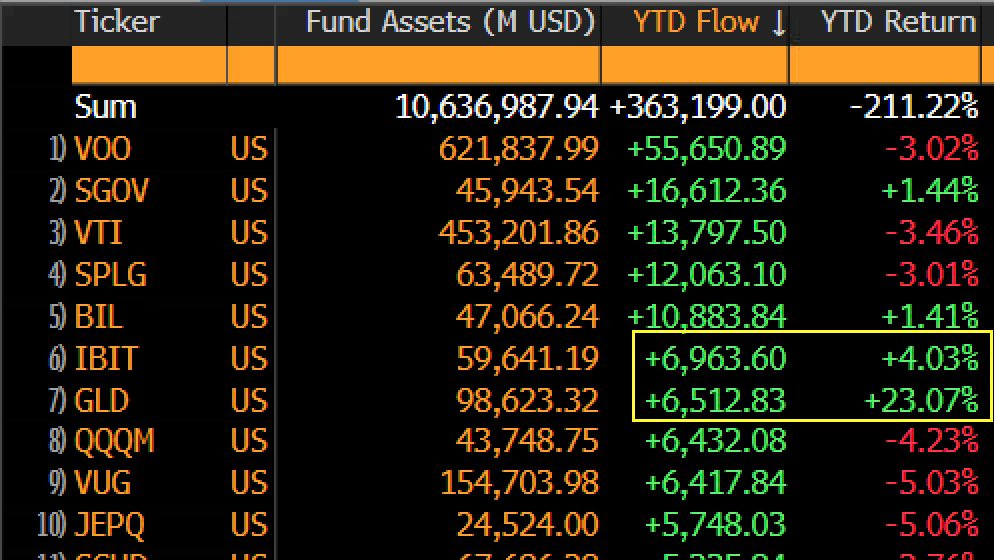

Blackrock’s Bitcoin ETF (IBIT) has received the 6th most inflows YTD across the entire ETF industry. (@SplitCapital)

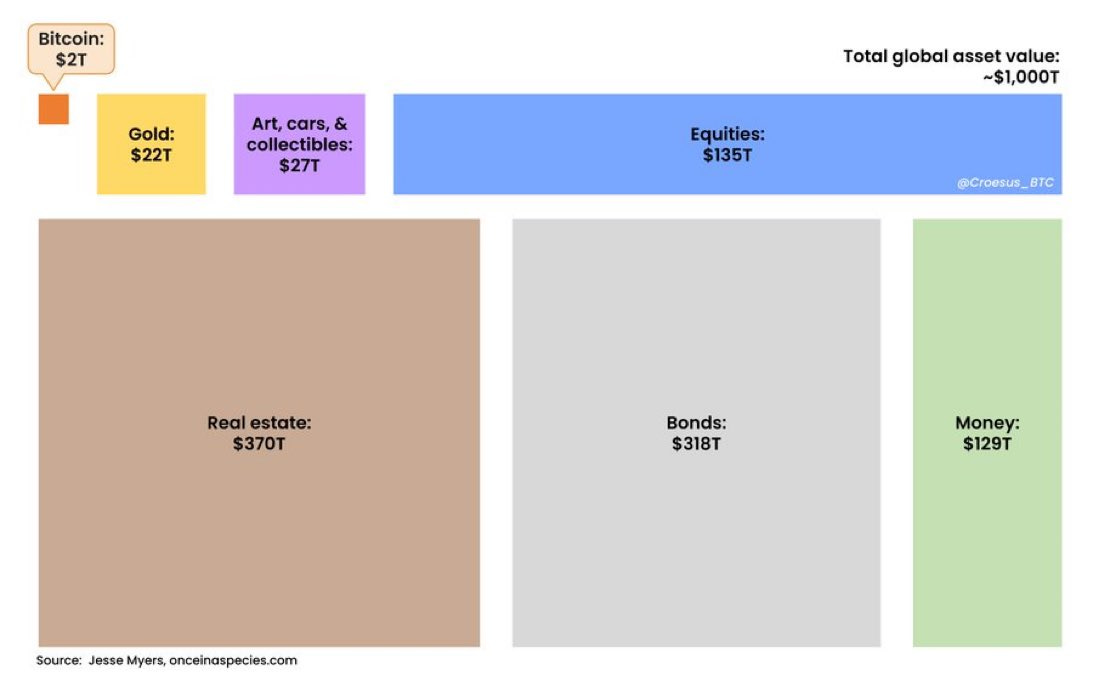

Bitcoiners are betting that Bitcoin will steal market share from other asset classes and continue to grow. It is a $2T asset compared to to $318T global bond market.(@Croesus_BTC)