Among some of the craziest things that are being discussed outside the Trump economic team these days is the broadcast of “bonds forever” to refinance the amazed nations of the debt, and to make it part of the current commercial negotiations, the post has learned.

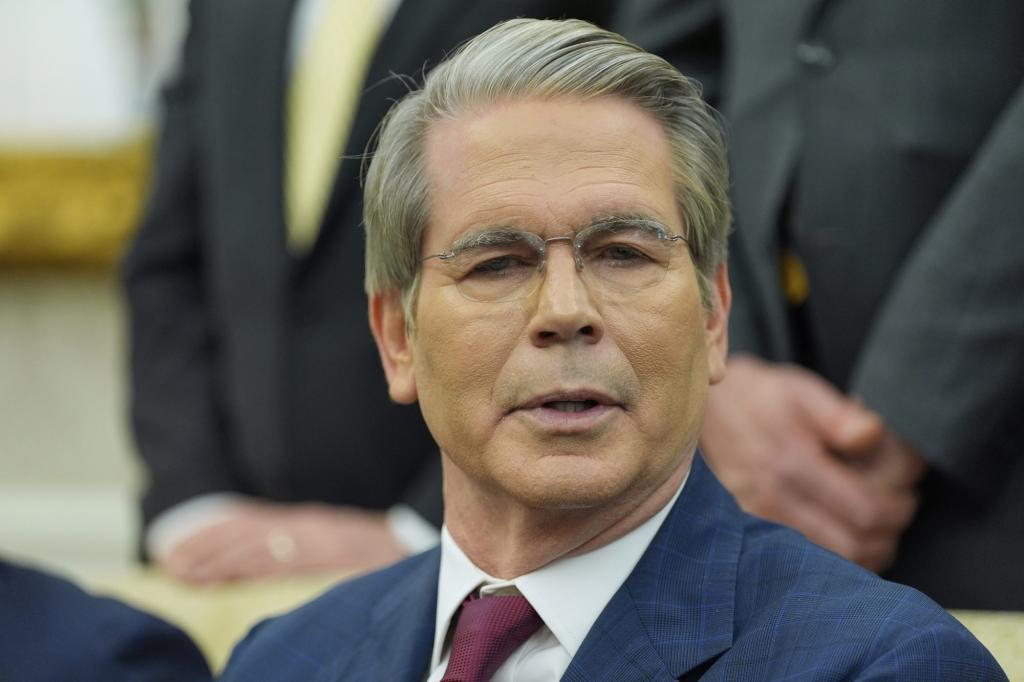

I have the leg assured by people close to Trump’s shoppingpot man, secretary of the Treasury Scott BesentThat the floating thesis of the 50 or 100 -year -old bonds is not close to the mentality as part of their negotiations or anything else.

“No, we are not talking about that,” a person near Berrus told me, with emphasis on the “no.”

An obvious reason why Besent would have no interest in the crazy idea is that he already has his hands completely negotiating innumerable commercial agreements with partners.

Some of them could bear fruit as soon as this week, with a possible agreement with Japan that seems increasingly likely.

Another is that markets do not need another acute turn in the possible destabilization after the administration turned the centerpiece of its economic agenda into a policy that exploits the global commercial system.

However, marginal discussions in government sometimes have a way to become the mainstream.

The emission of the bonds was always analyzed by the first term of the duration of Trump.

Trump Chief of the Council of Economic Advisors, Stephen lookIt has been a devotee of the bonus forever as part of a commercial pact that leads to manufacture and jobs to the United States.

And it is a substantial figure in Trump’s world.

Look, an economist with a PH.D. Harvard is also one of the key intellectual leaders, although leaders behind the current tariff plan.

While the Super Bond does not seem to be part of any negotiation, the past autumn Mira published published an essay that indicates that it could be used in a commercial agreement.

Hispieta, entitled “A user guide to restructure the global commercial system,” certainly caught Trump’s attention.

In it, they look argued that the dollar is too strong, so manufacturing hurts.

That is why factories have closed and trust in cheap Chinese products.

To reindustrialize the country, we need to find ways to depress “King Dollar” to make it cheaper than foreigners buy our products.

One way to do it is to reduce the agreements that force commercial partners to sell all their reservations in dollars, and then convert their short -term debt in Super Bucos.

That, in theory, restructure the country’s debt, currently at $ 36 billion, lower rates and pushes payments in the future.

Why go beyond 30 years?

Complete dissemination: I am not completely going through what is happening here with Miran’s thesis.

(His representative did not return a call to comment).

Most of our debt is fined to the old way, the 30 -year -old bonds being the most pulmonary expiration.

Why did anyone have a 5 -year -old bonus because to risk a 100 -year -old bonus, which recovers its director in the next century?

Most of my sources in Wall Street remembered that the Super Bond does not seem so super.

That is why they say that treasure people receded the duration of Trump 1 idea.

As a Wall Street CEO that deals with credit markets to make a living, he said: “Why would anyone do that?

The disadvantage would be immediate, experts said.

Markets could exploit about the concern that the United States needs to restructure its debt load.

We would literally tell bond buyers, we cannot pay our obligations now, so we must expel the interests and main payments in the future.

That is called “breach” and bond yields would shoot the moon, stock markets could block and the economy probably falls into a deep recession.

Heat in the new head of the SEC

The pressure continues to build on the new president of the Securities and Securities Commission. Paul Atkins To unleash the dogs of your application department in China Inc., according to the post.

Atkins will be sworn by President Trump earlier this week as the best Wall Street police.

Its first important investigation could be to determine if almost 300 headquarters in China represent a market capitalization of more than $ 1 billion of Shre-Shreing to be eliminated or eliminated from the EE securities markets. UU., According to people with direct knowledge of the medter.

The pressure comes from a variety of powerful legislators, including the Select Chamber Committee on China.

The sens. Rick Scott.

The post has learned that Atkins said it would.

The concern is that an investigation would shake the shares of Chinese companies if US investors settle over the talk that the Governor Chinese Communist Party has a hard hand in how they run.

After the column last week on calls to have an investigation, a spokesman for the select camera committee also told The Post It It, he is interested in accusations of poor quality revelations by Chinese lista companies about their ties with the PCCH, and that those caresses concern care about concerns.

The Committee was established in 2023 to monitor American competition with China and how the ruler Chinese Communist Party USA China Inc. to advance its strategic agenda or military and economic domination.

Executives who direct the companies on the Chinese list argue that the evidence of the participation of the PCCH in their operations is exaggerated or non -existent.

Also claiming something is much more difficult than trying, which will be necessary for any elimination.

That said, given the commercial war between the United States and China, the pressure to investigate the companies on the Chinese list will only grow and could lead to stress in those actions.